Popular on Rezul

- Denver Apartment Finders Launches Revamped Denver Tech Center Apartment Location Page

- Handy Homes Brings Membership-Based Home Maintenance to Short Hills, Maplewood, and Mil

- Still Using Ice? FrostSkin Reinvents Hydration

- Roblox and Solsten Alliances; a Stronger Balance Sheet and Accelerated Growth Through AI, Gaming, and Strategic Partnerships for Super League: $SLE

- UK Financial Ltd Lists MayaFund (MFUND) ERC-20 Token on CATEX Exchange Ahead of Planned ERC-3643 Upgrade

- Daniel Kaufman Launches a Vertically Integrated Real Estate and Investment Platform

- Scoop Social Co. Partners with Fairmont Hotels & Resorts to Elevate Summer Guest Experiences with Italian Inspired Gelato & Beverage Carts

- From Factory Floor to Community Heart: The Rebel Spirit of Wisconsin's Wet Wipe Innovators

- Volarex Named Chartered Consultant of the Year at Business UK National Awards

- Boston Industrial Solutions' Natron® 512N Series UV LED Ink Earns CPSIA Certification

Similar on Rezul

- $36 Million LOI to Acquire High Value Assets from Vivakor Inc in Oklahoma's STACK Play — Building Cash Flow and Scalable Power Infrastructure; $OLOX

- Kobie Wins for AI Innovations in the 2026 Stevie® Awards for Sales & Customer Service

- FDA Meeting Indicates a pivotal development that could redefine the treatment landscape for suicidal depression via NRx Pharmaceuticals: $NRXP

- $2.7 Million 2025 Revenue; All Time Record Sales Growth; 6 Profitable Quarters for Homebuilding Industry: Innovative Designs (Stock Symbol: IVDN)

- Slotozilla Reports Strong Q4 Growth and Sigma Rome Success

- Why KULR Could Be a Quiet Enabler of Space-Based Solar Power (SBSP) Over The Long Term: KULR Technology Group, Inc. (NY SE American: KULR)

- Why Finland Had No Choice But to Legalize Online Gambling

- High-Margin Energy & Digital Infrastructure Platform Created after Merger with Established BlockFuel Energy, Innovation Beverage Group (NAS DAQ: IBG)

- Municipal Carbon Field Guide Launched by LandConnect -- New Revenue Streams for Cities Managing Vacant Land

- Aleen Inc. (C S E: ALEN.U) Advances Digital Wellness Vision with Streamlined Platform Navigation and Long-Term Growth Strategy

First Bancorp of Indiana, Inc. Announces Financial Results December 2025

Rezul News/10727522

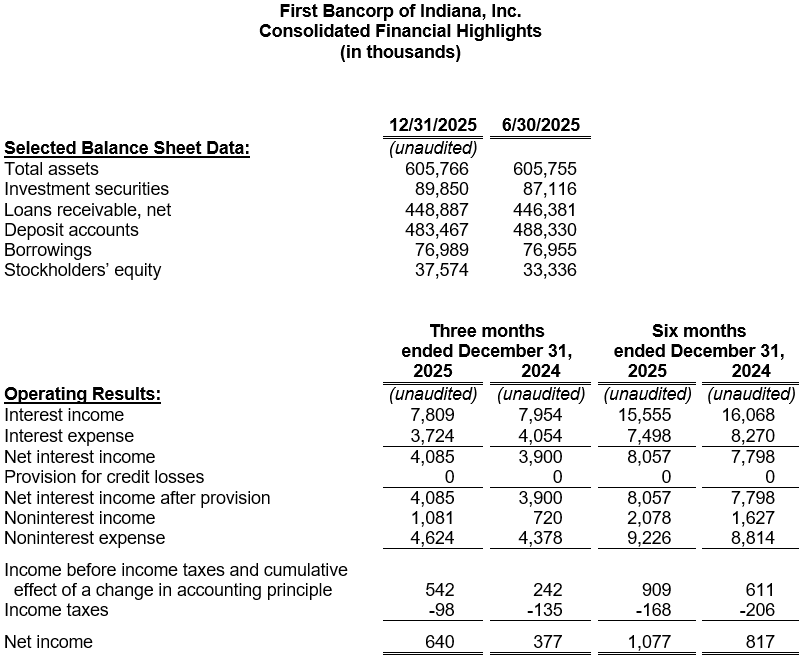

EVANSVILLE, Ind. - Rezul -- First Bancorp of Indiana, Inc. (OTCPK:FBPI), the holding company (the "Company") for First Federal Savings Bank (the "Bank"), reported earnings of $640,000 ($0.38 per diluted common share) for the second fiscal quarter ended December 31, 2025, compared to $377,000 ($0.22 per diluted common share) for the same quarter a year ago. Likewise, earnings for the first half of Fiscal 2026 totaled $1.08 million ($0.63 per diluted common share), compared to $817,000 ($0.48 per diluted common share) last fiscal year-to-date. Earnings for the six-month period equate to a return on average assets ("ROAA") of 0.36% and a return on average equity ("ROAE") of 6.14%. This compares to an annualized ROAA of 0.26% and an annualized ROAE of 4.92% last fiscal year.

"Our second fiscal quarter results reflect meaningful progress in strengthening earnings performance," stated Michael H. Head, President and CEO. "The improvement in returns on assets and equity underscores the benefits of our continued focus on disciplined growth, expense management, and balance sheet optimization."

Net interest income for the quarter ended December 31, 2025, improved from the prior year. Interest income from loans and investments declined but was outpaced by reductions in interest expense on deposits and borrowings. The Company's net interest margin ("NIM"), as a percentage of average interest-earning assets, was 2.88% for the six months ended December 31, 2025, an improvement from 2.66% as reported for the same timeframe last year. Noninterest income increased during the most recent quarter as gains on loan sales accelerated and a gain on a life insurance claim was recognized. The quarter over quarter rise in total non-interest expenses was largely attributed to higher compensation expense due to annual merit increases and to advertising costs from a deposit acquisition initiative.

The securities portfolio, which is primarily composed of investment-grade municipal bonds or obligations of US government agencies, totaled $89.9 million on December 31, 2025. No investments were added, so the modest increase was attributed to an improvement in the portfolio's fair market value, net of scheduled repayments.

Net loans outstanding, which totaled $448.9 million on December 31, 2025, have increased $2.5 million during the fiscal year. Commercial loan production totaled $23.4 million for the first half of the fiscal year, which included one $1.5 million SBA-backed loan. Single-family mortgage loan production, primarily originated for sale to FNMA or the Federal Home Loan Bank, increased to $12.0 million during the same timeframe. Construction lending accounted for 9.1% of this activity. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, totaled $9.0 million.

More on Rezul News

No provision for credit losses on loans was recorded in the six months ended December 31, 2025 or 2024. Net loan recoveries totaled $48,200 for the first two quarters of the fiscal year, compared to $75,800 of charge offs for the comparative quarters last year. The ratio of nonperforming loans 90 days or more delinquent to total loans was 0.22% on December 31, 2025, compared to 1.76% a year ago, primarily as the result of the successful restructuring of two large commercial relationships.

Overall, the Allowance for Credit Losses, including reserves for investment securities and unfunded commitments, stood at $5.36 million at December 31, 2025, compared to $5.57 million on December 31, 2024. The portion of the allowance attributed to the loan portfolio represented 1.15% of at-risk loans on December 31, 2025, compared to 1.14% last year. Management considers the allowance sufficient under current conditions but acknowledges that ongoing economic uncertainty and elevated inflation – characteristics of the current economic cycle – could negatively impact the credit quality of the loan portfolio. In response, management continues to closely monitor borrowers most affected by these challenges and stands ready to adjust the allowance as needed to address emerging risks.

Deposit accounts, totaling $483.5 million on December 31, 2025, declined by $4.9 million from the beginning of the fiscal year. The reduction was attributed to growth in local deposits that allowed the Bank to retire $31.7 million of higher-costing wholesale funding. Local deposit rates have moderated in recent months, resulting in the cost of deposits totaling 2.51% for the current quarter compared to 2.62% for the same quarter last fiscal year. Similarly, the Company's total cost of funds, including FHLB advances and debt of the holding company, totaled 2.65% for the quarter, compared to 2.76% for the quarter ended December 31, 2024.

As a part of the Bank's liquidity management plan, contingency funding sources are available and liquidity stress tests determine adequacy. At December 31, 2025, First Federal Savings Bank maintained lines of credit totaling $25.0 million at correspondent financial institutions and additional borrowing capacity with the Federal Reserve Bank's discount window ($6.7 million) and the Federal Home Loan Bank ($82.4 million).

Stockholders' equity reached $37.6 million as of December 31, 2025. This figure reflects a $6.5 million fair value adjustment to the available-for-sale securities portfolio, which improved due to the recent decline in market interest rates. This securities portfolio adjustment is not a part of the regulatory capital calculations, and gains or losses in the securities portfolio are only recognized if a security is sold. Based on the 1,707,291 outstanding common shares on December 31, 2025, the book value per share of FBPI stock was $22.01, compared to $19.39 on December 31, 2024.

More on Rezul News

On December 31, 2025, the Bank's Tier 1 Leverage, Tier 1 Risk Based and Total Risk Based Capital ratios were 8.96%, 13.01%, and 14.26%, respectively - improvements from 8.41%, 12.12% and 13.36% on December 31, 2024.

This press release may contain statements that are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors including, but not limited to: general economic conditions; prices for real estate in the Company's market areas; the interest rate environment and the impact of the interest rate environment on our business, financial condition and results of operations; our ability to successfully conserve and enhance capital levels, enhance liquidity and earnings, and reduce higher funding costs; the Company's ability to pay future dividends; the Bank's ability to pay dividends to the Company to fund the payment of cash dividends on the Company's common stock, and the ability of the Bank to receive any required regulatory approval or non-objection to do so; changes in the demand for loans or in the quality or composition of our loan or investment portfolios; deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected as a result of changes in relevant accounting or regulatory requirements, among other factors; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the outcome of pending or threatened litigation, or of matters before regulatory agencies; changes in law, governmental policies and regulations; and rapidly changing technology affecting financial services. Accordingly, actual results may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company or any other person that results expressed therein will be achieved. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

"Our second fiscal quarter results reflect meaningful progress in strengthening earnings performance," stated Michael H. Head, President and CEO. "The improvement in returns on assets and equity underscores the benefits of our continued focus on disciplined growth, expense management, and balance sheet optimization."

Net interest income for the quarter ended December 31, 2025, improved from the prior year. Interest income from loans and investments declined but was outpaced by reductions in interest expense on deposits and borrowings. The Company's net interest margin ("NIM"), as a percentage of average interest-earning assets, was 2.88% for the six months ended December 31, 2025, an improvement from 2.66% as reported for the same timeframe last year. Noninterest income increased during the most recent quarter as gains on loan sales accelerated and a gain on a life insurance claim was recognized. The quarter over quarter rise in total non-interest expenses was largely attributed to higher compensation expense due to annual merit increases and to advertising costs from a deposit acquisition initiative.

The securities portfolio, which is primarily composed of investment-grade municipal bonds or obligations of US government agencies, totaled $89.9 million on December 31, 2025. No investments were added, so the modest increase was attributed to an improvement in the portfolio's fair market value, net of scheduled repayments.

Net loans outstanding, which totaled $448.9 million on December 31, 2025, have increased $2.5 million during the fiscal year. Commercial loan production totaled $23.4 million for the first half of the fiscal year, which included one $1.5 million SBA-backed loan. Single-family mortgage loan production, primarily originated for sale to FNMA or the Federal Home Loan Bank, increased to $12.0 million during the same timeframe. Construction lending accounted for 9.1% of this activity. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, totaled $9.0 million.

More on Rezul News

- Florida Keys Visitors Can Save 15 Percent With KeysCaribbean's Advanced Booking Discount

- Detroit Homeowners Facing Property Tax Foreclosure Explore Options to Sell Before Losing Their Homes

- Sleep Basil Unveils Revamped Natural Latex Mattress Collection Page for Cooler, Cleaner, Better-Aligned Sleep

- Conexwest Delivers Custom Shipping Container MRI Lab, Saving California Hospital an Estimated $9 Million in Renovation Costs

- DASH Carolina RDU Sets the Pace in 2025 with Record-Breaking Sales and Team Excellence

No provision for credit losses on loans was recorded in the six months ended December 31, 2025 or 2024. Net loan recoveries totaled $48,200 for the first two quarters of the fiscal year, compared to $75,800 of charge offs for the comparative quarters last year. The ratio of nonperforming loans 90 days or more delinquent to total loans was 0.22% on December 31, 2025, compared to 1.76% a year ago, primarily as the result of the successful restructuring of two large commercial relationships.

Overall, the Allowance for Credit Losses, including reserves for investment securities and unfunded commitments, stood at $5.36 million at December 31, 2025, compared to $5.57 million on December 31, 2024. The portion of the allowance attributed to the loan portfolio represented 1.15% of at-risk loans on December 31, 2025, compared to 1.14% last year. Management considers the allowance sufficient under current conditions but acknowledges that ongoing economic uncertainty and elevated inflation – characteristics of the current economic cycle – could negatively impact the credit quality of the loan portfolio. In response, management continues to closely monitor borrowers most affected by these challenges and stands ready to adjust the allowance as needed to address emerging risks.

Deposit accounts, totaling $483.5 million on December 31, 2025, declined by $4.9 million from the beginning of the fiscal year. The reduction was attributed to growth in local deposits that allowed the Bank to retire $31.7 million of higher-costing wholesale funding. Local deposit rates have moderated in recent months, resulting in the cost of deposits totaling 2.51% for the current quarter compared to 2.62% for the same quarter last fiscal year. Similarly, the Company's total cost of funds, including FHLB advances and debt of the holding company, totaled 2.65% for the quarter, compared to 2.76% for the quarter ended December 31, 2024.

As a part of the Bank's liquidity management plan, contingency funding sources are available and liquidity stress tests determine adequacy. At December 31, 2025, First Federal Savings Bank maintained lines of credit totaling $25.0 million at correspondent financial institutions and additional borrowing capacity with the Federal Reserve Bank's discount window ($6.7 million) and the Federal Home Loan Bank ($82.4 million).

Stockholders' equity reached $37.6 million as of December 31, 2025. This figure reflects a $6.5 million fair value adjustment to the available-for-sale securities portfolio, which improved due to the recent decline in market interest rates. This securities portfolio adjustment is not a part of the regulatory capital calculations, and gains or losses in the securities portfolio are only recognized if a security is sold. Based on the 1,707,291 outstanding common shares on December 31, 2025, the book value per share of FBPI stock was $22.01, compared to $19.39 on December 31, 2024.

More on Rezul News

- Colliers completes sale of land along Goodson Loop off FM 1774 in Pinehurst, Texas

- Phoenix & Scottsdale Homeowners Facing Divorce Need Clear Real Estate Guidance in 2026

- What San Antonio Homeowners Should Know Before Selling a House That Needs Major Repairs

- FDA Meeting Indicates a pivotal development that could redefine the treatment landscape for suicidal depression via NRx Pharmaceuticals: $NRXP

- $2.7 Million 2025 Revenue; All Time Record Sales Growth; 6 Profitable Quarters for Homebuilding Industry: Innovative Designs (Stock Symbol: IVDN)

On December 31, 2025, the Bank's Tier 1 Leverage, Tier 1 Risk Based and Total Risk Based Capital ratios were 8.96%, 13.01%, and 14.26%, respectively - improvements from 8.41%, 12.12% and 13.36% on December 31, 2024.

This press release may contain statements that are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors including, but not limited to: general economic conditions; prices for real estate in the Company's market areas; the interest rate environment and the impact of the interest rate environment on our business, financial condition and results of operations; our ability to successfully conserve and enhance capital levels, enhance liquidity and earnings, and reduce higher funding costs; the Company's ability to pay future dividends; the Bank's ability to pay dividends to the Company to fund the payment of cash dividends on the Company's common stock, and the ability of the Bank to receive any required regulatory approval or non-objection to do so; changes in the demand for loans or in the quality or composition of our loan or investment portfolios; deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected as a result of changes in relevant accounting or regulatory requirements, among other factors; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the outcome of pending or threatened litigation, or of matters before regulatory agencies; changes in law, governmental policies and regulations; and rapidly changing technology affecting financial services. Accordingly, actual results may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company or any other person that results expressed therein will be achieved. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

Source: First Bancorp of Indiana Inc

Filed Under: Financial

0 Comments

Latest on Rezul News

- Slotozilla Reports Strong Q4 Growth and Sigma Rome Success

- "Lights Off" and Laughs On: Joseph Neibich Twists Horror Tropes in Hilariously Demonic Fashion

- Families Gain Clarity: Postmortem Pathology Expands Private Autopsy Services in St. Louis

- Beethoven: Music of Revolution and Triumph - Eroica

- Amy Turner Receives 2025 ENPY Partnership Builder Award from The Community Foundation

- Hubble Tension Solved? Study finds evidence of an 'Invisible Bias' in How We Measure the Universe

- Jacksonville Homeowners Increasingly Selling Houses As-Is as Maintenance Costs Rise

- Colliers facilitates sale of prime manufacturing facility in north Houston

- Boonuspart.ee Acquires Kasiino-boonus.ee to Strengthen Its Position in the Estonian iGaming Market

- Vines of Napa Launches Partnership Program to Bolster Local Tourism and Economic Growth

- Finland's €1.3 Billion Digital Gambling Market Faces Regulatory Tug-of-War as Player Protection Debate Intensifies

- Angels Of Dirt Premieres on Youtube, Announces Paige Keck Helmet Sponsorship for 2026 Season

- Still Using Ice? FrostSkin Reinvents Hydration

- Patron Saints Of Music Names Allie Moskovits Head Of Sync & Business Development

- Dave Aronberg Named 2026 John C. Randolph Award Recipient by Palm Beach Fellowship of Christians & Jews

- General Relativity Challenged by New Tension Discovered in Dark Siren Cosmology

- Burkentine Real Estate Group to Bring A New Community to Millersville, Pennsylvania

- Unseasonable Warmth Triggers Early Pest Season Along I-5 Corridor

- Berkshire Hathaway HomeServices FNR's Ann King named RISMedia Real Estate Newsmaker

- Houston Homeowners Choosing As-Is Home Sales as Repair Costs and Market Conditions Shift