Popular on Rezul

- eJoule Inc Participates in Silicon Dragon CES 2026

- Central Florida Real Estate Market Shows Buyer-Friendly Shift Heading Into the New Year

- Guests Can Save 25 Percent Off Last Minute Bookings at KeysCaribbean's Village at Hawks Cay Villas

- Golden Paper Launches a New Chapter in Its Americas Strategy- EXPOPRINT Latin America 2026 in Brazil

- End of the Year Sales Was a Smart Move for Many Home Buyers

- Genuine Hospitality, LLC Selected to Operate Hilton Garden Inn Birmingham SE / Liberty Park

- TheOneLofi2: New Home for Chill Lo-Fi Hip Hop Beats Launches on YouTube

- Donna Cardellino Manager/Facilitator Signs Justin Jeansonne Country Singer-Songwriter To Exclusive Management Deal For Global Music Expansion

- The 22% Tax Reality: Finland's New Gambling Law Creates a "Fiscal Trap" for Grey Market Casino Players

- ERA Sunrise, ERA Foster & Bond Finalize Strategic Merger

Similar on Rezul

- Cyntexa Outlines a Principles-first Approach to Modern Enterprise Transformation

- Kickstarter And Creator Camp Partner To Support A New Era Of Creator-led Independent Film

- Top 66 People-Centric Leaders of 2025 Prove Taking Care of People Is Taking Care of Business

- ULI North Florida to recognize Shad Khan as Visionary Leader at the 2026 ULI Awards for Excellence

- Paramount Commercial Partners Represents JF Fitness of North America in Oxford, Alabama Lease

- Stockdale Capital Refinances Recent Scottsdale, AZ Acquisition with $72.3 M Loan from Nuveen

- Winter Weather Doesn't Have to Mean Home Damage, Says Oklahoma Roofing Expert

- Daniel Kaufman Launches a Vertically Integrated Real Estate and Investment Platform

- Impact Futures Group expands through acquisition of specialist healthcare sector training provider Caring for Care

- Finland's New Gambling Watchdog Handed Sweeping Powers to Revoke Licenses and Block Illegal Casino Sites

Wall Street's New Obsession? Tradewinds Aims to Revolutionize the $8B Gentlemen's Club Industry with National Peppermint Hippo™ Strategy $TRWD

Rezul News/10718581

Tradewinds Universal, Inc. (Symbol: TRWD) $TRWD Strategic Roadmap Includes Uplisting to NASDAQ or NYSE Emphasizing Tangible, Revenue-Generating Assets

BREA, Calif. - Rezul -- In a move that is catching the eye of institutional investors, Tradewinds Universal, Inc. (Stock Symbol: $TRWD) has unveiled a bold and highly scalable plan to consolidate and modernize one of America's most fragmented yet profitable sectors — adult nightlife. And they're doing it with the backing of one of the fastest-growing brands in the space: Peppermint Hippo™.

With a strategic roadmap pointing toward an uplisting to N A S D A Q or N Y S E, TRWD's vision is clear: to become the first major national platform in the $8 billion gentlemen's club niche by acquiring, upgrading, and operating clubs under the Peppermint Hippo brand — and investors are beginning to take notice.

🔥 A Disruptive Growth Story in the Making

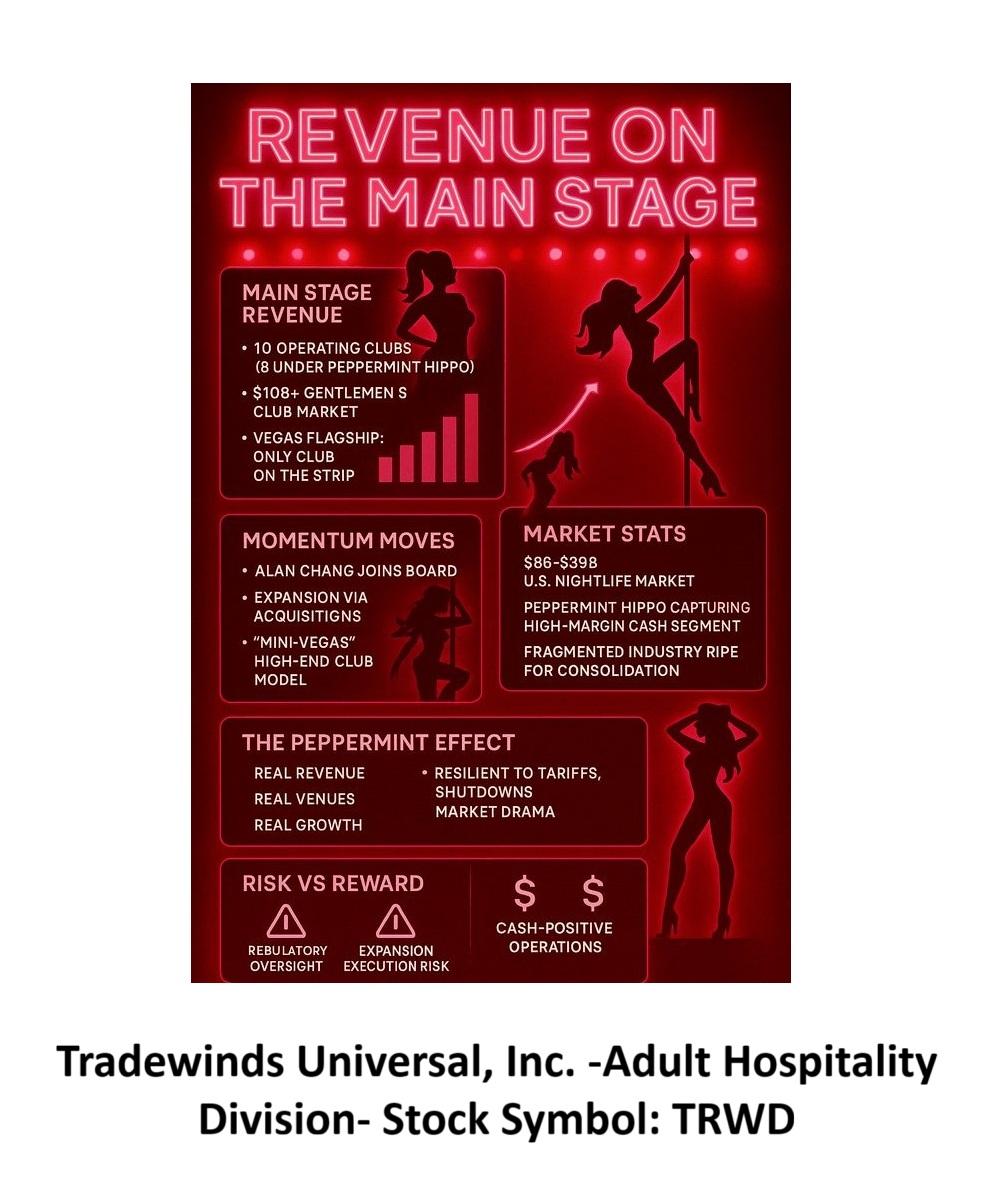

TRWD has signed a Letter of Intent (LOI) with Peppermint Hippo™ to acquire up to eight clubs in the near term, with many more in the pipeline. The first club acquisition — located in Toledo, Ohio — is set to be the flagship of what will become a powerful, branded nightlife division within TRWD.

But this isn't a simple roll-up strategy. Under the leadership of Alan Chang, CEO of Peppermint Hippo and Director at TRWD, the company plans to scale to 100+ clubs nationwide, transforming locally run establishments into high-end, Mini-Vegas-style experiences that combine luxury aesthetics, streamlined operations, and brand consistency.

🎙️ "Our vision is to take a highly profitable but disjointed industry and apply brand discipline, professional management, and scalability," says Alan Chang in his exclusive BizTrendWatch interview, now live on YouTube. Watch here

More on Rezul News

💡 Why Investors Are Paying Attention

The U.S. bars and nightlife market is valued between $36–$39 billion annually, and the gentlemen's club segment alone accounts for an estimated $8 billion. Despite high margins, most clubs are owner-operated, with limited branding and low institutional participation.

$TRWD is now positioning itself as one of the only public platforms focused on consolidating and professionalizing this market. That matters — especially for investors looking for exposure to recession-resilient, cash-flow-generating assets.

Here's what sets the TRWD strategy apart:

✅ Tangible, Revenue-Producing Assets

✅ Professional Corporate Governance (SEC/PCAOB Compliant)

✅ Strong Brand Equity with Peppermint Hippo™

✅ Clear Path to Major Exchange Uplisting (N A S D A Q or N Y S E)

✅ Operational Infrastructure Already in Motion

🎯 Strategic Rollout: From Niche to Nationwide

The upcoming acquisitions will be part of a new Adult Hospitality Division under TRWD. This unit will incorporate Peppermint Hippo clubs and affiliated brands, creating a vertically integrated nightlife empire with centralized marketing, infrastructure, and financial reporting.

According to TRWD's latest update, the company is currently:

🎥 A recent corporate update video highlights the company's aggressive yet disciplined approach. Watch it here

👀 The Only Public Peer? RCI Hospitality ($RICK)

TRWD's expansion and the Peppermint Hippo model will soon be analyzed against RCI Hospitality Holdings (N A S D A Q: RICK) — currently the only significant public company in the space. A forthcoming analyst comparison report by BizTrendWatch is expected to give investors clear context into valuation, strategy, and growth potential.

More on Rezul News

🧠 Big Vision: Building a Conglomerate, Not Just Clubs

Beyond gentlemen's clubs, (Stock Symbol: $TRWD) envisions building a broader nightlife and entertainment conglomerate, incorporating complementary brands that share operations, data, and marketing platforms — a multi-brand, multi-venue powerhouse akin to a publicly traded version of a hospitality unicorn.

"Our goal is to redefine adult hospitality as an asset-backed, institutional-grade business model — not just entertainment," Chang emphasizes.

🚀 Key Takeaways for Investors

📲 Stay Informed

📢 Follow TRWD on X (Twitter): @OfficialTRWD

📎 Learn more at: https://tradewindsuniversal.com/

📧 Investor Contact: IR@tradewindsuniversal.com

📞 Phone: (619) 483-1008

Bottom Line:

$TRWD isn't just buying clubs — it's building a national brand. With proven leadership, real assets, and a clear roadmap to public market expansion, TRWD represents one of the most compelling growth stories in the overlooked but lucrative adult hospitality space.

Investors looking for cash flow, consolidation, and brand-scale potential may want to keep TRWD on their radar — before the uplisting bells start ringing.

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a strategic roadmap pointing toward an uplisting to N A S D A Q or N Y S E, TRWD's vision is clear: to become the first major national platform in the $8 billion gentlemen's club niche by acquiring, upgrading, and operating clubs under the Peppermint Hippo brand — and investors are beginning to take notice.

🔥 A Disruptive Growth Story in the Making

TRWD has signed a Letter of Intent (LOI) with Peppermint Hippo™ to acquire up to eight clubs in the near term, with many more in the pipeline. The first club acquisition — located in Toledo, Ohio — is set to be the flagship of what will become a powerful, branded nightlife division within TRWD.

But this isn't a simple roll-up strategy. Under the leadership of Alan Chang, CEO of Peppermint Hippo and Director at TRWD, the company plans to scale to 100+ clubs nationwide, transforming locally run establishments into high-end, Mini-Vegas-style experiences that combine luxury aesthetics, streamlined operations, and brand consistency.

🎙️ "Our vision is to take a highly profitable but disjointed industry and apply brand discipline, professional management, and scalability," says Alan Chang in his exclusive BizTrendWatch interview, now live on YouTube. Watch here

More on Rezul News

- Paramount Commercial Partners Represents JF Fitness of North America in Oxford, Alabama Lease

- Stockdale Capital Refinances Recent Scottsdale, AZ Acquisition with $72.3 M Loan from Nuveen

- Winter Weather Doesn't Have to Mean Home Damage, Says Oklahoma Roofing Expert

- Daniel Kaufman Launches a Vertically Integrated Real Estate and Investment Platform

- Long Long Tales: Bilingual Cartoon Series on Youtube Celebrating Chinese New Year

💡 Why Investors Are Paying Attention

The U.S. bars and nightlife market is valued between $36–$39 billion annually, and the gentlemen's club segment alone accounts for an estimated $8 billion. Despite high margins, most clubs are owner-operated, with limited branding and low institutional participation.

$TRWD is now positioning itself as one of the only public platforms focused on consolidating and professionalizing this market. That matters — especially for investors looking for exposure to recession-resilient, cash-flow-generating assets.

Here's what sets the TRWD strategy apart:

✅ Tangible, Revenue-Producing Assets

✅ Professional Corporate Governance (SEC/PCAOB Compliant)

✅ Strong Brand Equity with Peppermint Hippo™

✅ Clear Path to Major Exchange Uplisting (N A S D A Q or N Y S E)

✅ Operational Infrastructure Already in Motion

🎯 Strategic Rollout: From Niche to Nationwide

The upcoming acquisitions will be part of a new Adult Hospitality Division under TRWD. This unit will incorporate Peppermint Hippo clubs and affiliated brands, creating a vertically integrated nightlife empire with centralized marketing, infrastructure, and financial reporting.

According to TRWD's latest update, the company is currently:

- Finalizing due diligence on Peppermint Hippo Toledo

- Progressing through legal, licensing, and regulatory frameworks

- Coordinating SEC and PCAOB-compliant audits

- Preparing for seamless integration into TRWD's public reporting structure

🎥 A recent corporate update video highlights the company's aggressive yet disciplined approach. Watch it here

👀 The Only Public Peer? RCI Hospitality ($RICK)

TRWD's expansion and the Peppermint Hippo model will soon be analyzed against RCI Hospitality Holdings (N A S D A Q: RICK) — currently the only significant public company in the space. A forthcoming analyst comparison report by BizTrendWatch is expected to give investors clear context into valuation, strategy, and growth potential.

More on Rezul News

- MAX Illumination Redefines Cabinet Displays with New Edge-Lit LED Technology

- Impact Futures Group expands through acquisition of specialist healthcare sector training provider Caring for Care

- FeedSocially - Post Once, Publish Everywhere

- James D. Harding Promoted to Century Fasteners Corp. – Managing Director

- Finland's New Gambling Watchdog Handed Sweeping Powers to Revoke Licenses and Block Illegal Casino Sites

🧠 Big Vision: Building a Conglomerate, Not Just Clubs

Beyond gentlemen's clubs, (Stock Symbol: $TRWD) envisions building a broader nightlife and entertainment conglomerate, incorporating complementary brands that share operations, data, and marketing platforms — a multi-brand, multi-venue powerhouse akin to a publicly traded version of a hospitality unicorn.

"Our goal is to redefine adult hospitality as an asset-backed, institutional-grade business model — not just entertainment," Chang emphasizes.

🚀 Key Takeaways for Investors

- Massive Market Opportunity: $36–$39B nightlife market; $8B gentlemen's club niche

- Peppermint Hippo Brand: Already proven with existing club network and loyal following

- Public Company Advantage: Institutional access, transparency, scale

- Path to N A S D A Q / N Y S E: Emphasis on revenue-generating, tangible assets supports major exchange uplisting

- Strong Leadership: CEO Alan Chang brings brand expertise and national vision

📲 Stay Informed

📢 Follow TRWD on X (Twitter): @OfficialTRWD

📎 Learn more at: https://tradewindsuniversal.com/

📧 Investor Contact: IR@tradewindsuniversal.com

📞 Phone: (619) 483-1008

Bottom Line:

$TRWD isn't just buying clubs — it's building a national brand. With proven leadership, real assets, and a clear roadmap to public market expansion, TRWD represents one of the most compelling growth stories in the overlooked but lucrative adult hospitality space.

Investors looking for cash flow, consolidation, and brand-scale potential may want to keep TRWD on their radar — before the uplisting bells start ringing.

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on Rezul News

- Home Prices Just Hit 5X Median Income — So Americans Are Buying Businesses Instead of Houses

- 2026 Brevard County, FL Rental Property Investment Forecast

- Mid West Displays Launches Standoff Deal

- CCHR White Paper Urges Government Crackdown on Troubled Teen and For-Profit Psychiatric Facilities

- Still Searching for the Perfect Valentine's Gift? Lick Personal Oils Offers Romantic, Experience-Driven Alternatives to Traditional Presents

- Boston Industrial Solutions' BPA Certified BX Series Raises the Bar for Pad Printing Inks

- Title Junction to Host Free Florida Homestead Exemption Filing Events This February

- Spencer Buys Houses: 500+ Homes Bought in Memphis

- Jenks Open House Highlights More Than a Home

- Boston Corporate Coach™ Sets Global Standard for Executive Chauffeur Services Across 680 Cities

- Expert Tips from Silva Construction: How to Avoid Common Home Renovation Mistakes

- UK Financial Ltd Announces CoinMarketCap Supply Verification And Market Positioning Review For Regulated Security Tokens SMPRA And SMCAT

- Sharpe Automotive Redefines Local Car Care with "Transparency-First" Service Model in Santee

- Diversified Roofing Solutions Launches Asphalt Shingle Roof Division to Serve Residential Homeowners

- Colony Ridge Community Celebrates New RoadTrac Gas Station Grand Opening with Live Entertainment and Giveaways

- George Nausha Joins PXV Multifamily As Managing Director Acquisitions

- Secondesk Launches Powerful AI Tutor That Speaks 20+ Languages

- Automation, innovation in healthcare processes featured at international conference in Atlanta

- A High-Velocity Growth Story Emerges in Marine and Luxury Markets

- $26 Billion Global Market by 2035 for Digital Assets Opens Major Potential for Currency Tech Company with ATM Expansion and Deployment Plans Underway