Popular on Rezul

- Still Using Ice? FrostSkin Reinvents Hydration

- Denver Apartment Finders Launches Revamped Denver Tech Center Apartment Location Page

- Handy Homes Brings Membership-Based Home Maintenance to Short Hills, Maplewood, and Mil

- Roblox and Solsten Alliances; a Stronger Balance Sheet and Accelerated Growth Through AI, Gaming, and Strategic Partnerships for Super League: $SLE

- UK Financial Ltd Lists MayaFund (MFUND) ERC-20 Token on CATEX Exchange Ahead of Planned ERC-3643 Upgrade

- Volarex Named Chartered Consultant of the Year at Business UK National Awards

- Scoop Social Co. Partners with Fairmont Hotels & Resorts to Elevate Summer Guest Experiences with Italian Inspired Gelato & Beverage Carts

- Boston Industrial Solutions' Natron® 512N Series UV LED Ink Earns CPSIA Certification

- From Factory Floor to Community Heart: The Rebel Spirit of Wisconsin's Wet Wipe Innovators

- Power Business Solutions Announces Joint Venture with EIG Global Trust to Deliver Data Center Financial Solutions

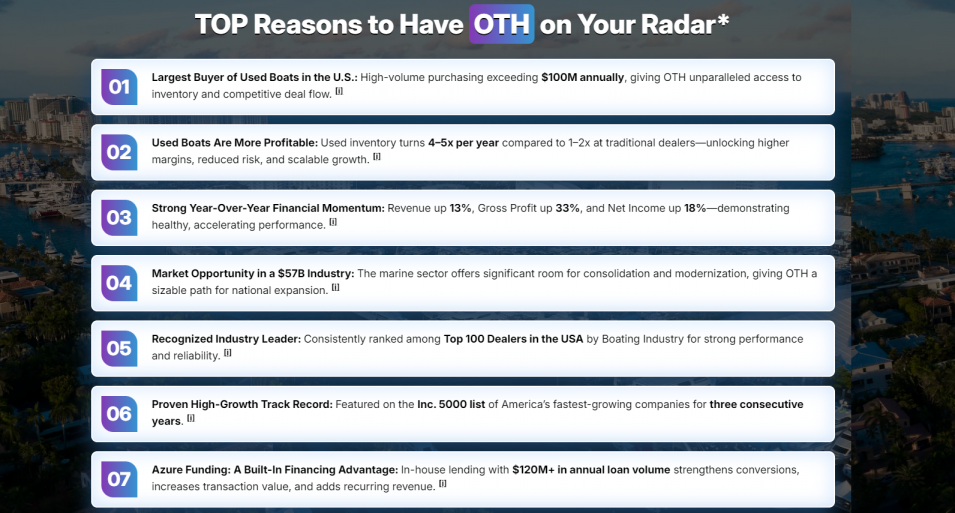

Off The Hook YS (NY SE: OTH) Executes Transformational Apex Acquisition, Creating Vertically Integrated Marine Powerhouse with $60M Inventory Capacity

Rezul News/10728078

Off The Hook YS Inc. (NYSE American: OTH), $OTH Realizes $60 Million Inventory Capacity, $100 Million in Luxury Listings, Strategic Global Partnerships and $140–$145 Million 2026 Revenue Outlook Position OTH for Continued Expansion in the $57 Billion U.S. Marine Market

WILMINGTON, N.C. - Rezul -- Off The Hook YS, Inc. (NYSE American: OTH), one of America's largest buyers and sellers of pre-owned boats, has signed a definitive agreement to acquire Apex Marine Group of Companies (APEX), a premier South Florida marine service, storage, and sales organization. The acquisition is expected to close within 60 days and represents a significant step in OTH's strategy to vertically integrate operations, increase margin capture, and expand its global customer reach.

Founded in 2012 and headquartered in Wilmington, North Carolina, OTH acquires more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas and has consistently earned recognition on the Inc. 500 while ranking among the Top 100 Dealers in the United States. Since completing its IPO in 2025, OTH has continued expanding its footprint through disciplined growth, technology adoption, and strategic partnerships.

Transformational Apex Acquisition

The Apex transaction delivers four strategically located South Florida facilities, including haul-out capability up to 150 metric tons and vessels up to 130 feet. The facilities feature comprehensive in-house service teams capable of handling repair, refit, and refurbishment across nearly every major discipline.

By internalizing service and refurbishment operations, OTH expects to improve operational efficiency, reduce turnaround times, enhance quality control, and strengthen margins. The centralized South Florida campus will also serve as a destination hub, allowing domestic and international buyers to access tens of millions of dollars in competitively priced inventory in one location near Fort Lauderdale and Miami.

The acquisition includes representation of respected brands such as Pursuit in Miami and Solace and Fountain from Ft. Pierce to Key West. Apex has consistently ranked among the top new boat dealers in Southeast Florida, further strengthening OTH's credibility and positioning within the marine ecosystem.

More on Rezul News

Strategic Expansion Across Key Markets

To complement the Apex acquisition, OTH has entered into strategic partnerships designed to accelerate geographic expansion without heavy brick-and-mortar investment.

Through its agreement with Jefferson Beach Yacht Sales, a Michigan-based brokerage with over 50 years of operating history and nine locations across the Great Lakes and Florida, OTH receives a right of first refusal on 100% of JBYS yacht trades. This creates a high-velocity pipeline of used boats while providing immediate access to key regional markets.

Additionally, OTH expanded into the Caribbean and Latin American markets through a strategic agreement with CFR Yacht Sales. The partnership provides preferred access to select pre-owned vessels generated through CFR's brokerage operations, along with sourcing, verification, and transport coordination across Puerto Rico and surrounding markets.

These partnerships allow OTH to scale inventory flow and regional presence while maintaining a centralized, technology-driven operating model.

Technology-Driven Competitive Advantage

A core differentiator for OTH is its AI-assisted valuation tools and data-driven sales platform. The company leverages advanced analytics to increase pricing transparency, accelerate buyer-seller matching, and improve transaction velocity. This technology-driven model supports higher conversion rates, faster inventory turns, and improved customer experience across brokerage, wholesale, and performance yacht sales.

Strengthening Financial Capacity

OTH continues to reinforce its capital position to support growth. The company recently expanded its inventory financing floorplan to $60 million, more than doubling prior capacity. This enhanced facility enables OTH to acquire and carry a broader selection of high-quality pre-owned boats across multiple categories and geographies, driving sales velocity and customer engagement.

For the first nine months of 2025, OTH reported record revenue of $82.6 million, representing 19.3% year-over-year growth. The company projects full-year 2026 revenue between $140 million and $145 million as it continues executing its expansion strategy.

More on Rezul News

Since launching its luxury brokerage division in October, OTH has secured $100 million in listings and closed 22 transactions totaling $35 million, demonstrating traction in higher-value yacht segments.

Strategic Dealer Incentives and Shareholder Alignment

In January, OTH launched a nationwide dealer incentive program through a partnership with flyExclusive, Inc., one of the nation's leading private aviation operators. The performance-based incentive structure rewards high-performing dealers with private aviation flight hours, designed to deepen engagement and increase boat intake volume nationwide.

The company has also authorized a share repurchase program of up to $1 million, signaling management's confidence in the company's long-term outlook while continuing to prioritize strategic investments in inventory, technology, and infrastructure.

Positioned in a Large and Growing Industry

The U.S. marine industry is valued at approximately $57 billion. Additionally, the U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, reflecting a 7.52% compound annual growth rate. With expanded service infrastructure through Apex and increased inventory capacity, OTH appears well positioned to participate in this long-term growth trend.

In January 2026, Think Equity released its initial research report on OTH with a $10 per share price target, further highlighting institutional awareness of the company's growth trajectory.

With a vertically integrated operating model, expanding geographic reach, strengthened capital capacity, and technology-enabled transaction platform, Off The Hook YS continues to build a scalable marine enterprise designed for sustained revenue growth and operational leverage.

NYSE American: OTH — Expanding Infrastructure. Scaling Technology. Accelerating Growth.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Founded in 2012 and headquartered in Wilmington, North Carolina, OTH acquires more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas and has consistently earned recognition on the Inc. 500 while ranking among the Top 100 Dealers in the United States. Since completing its IPO in 2025, OTH has continued expanding its footprint through disciplined growth, technology adoption, and strategic partnerships.

Transformational Apex Acquisition

The Apex transaction delivers four strategically located South Florida facilities, including haul-out capability up to 150 metric tons and vessels up to 130 feet. The facilities feature comprehensive in-house service teams capable of handling repair, refit, and refurbishment across nearly every major discipline.

By internalizing service and refurbishment operations, OTH expects to improve operational efficiency, reduce turnaround times, enhance quality control, and strengthen margins. The centralized South Florida campus will also serve as a destination hub, allowing domestic and international buyers to access tens of millions of dollars in competitively priced inventory in one location near Fort Lauderdale and Miami.

The acquisition includes representation of respected brands such as Pursuit in Miami and Solace and Fountain from Ft. Pierce to Key West. Apex has consistently ranked among the top new boat dealers in Southeast Florida, further strengthening OTH's credibility and positioning within the marine ecosystem.

More on Rezul News

- Bergen County Retail Momentum Continues

- ZRCalc™ Cinema Card Calculator Now Available for Nikon ZR Shooters

- Roof Repair vs. Roof Replacement: Oklahoma Homeowners Urged to Decide Before Storm Season

- Cleveland Vacant Property Owners Exploring Faster Home Selling Options as Maintenance Costs Rise

- Revolutionary Data Solution Transforms Health Insurance Underwriting Accuracy

Strategic Expansion Across Key Markets

To complement the Apex acquisition, OTH has entered into strategic partnerships designed to accelerate geographic expansion without heavy brick-and-mortar investment.

Through its agreement with Jefferson Beach Yacht Sales, a Michigan-based brokerage with over 50 years of operating history and nine locations across the Great Lakes and Florida, OTH receives a right of first refusal on 100% of JBYS yacht trades. This creates a high-velocity pipeline of used boats while providing immediate access to key regional markets.

Additionally, OTH expanded into the Caribbean and Latin American markets through a strategic agreement with CFR Yacht Sales. The partnership provides preferred access to select pre-owned vessels generated through CFR's brokerage operations, along with sourcing, verification, and transport coordination across Puerto Rico and surrounding markets.

These partnerships allow OTH to scale inventory flow and regional presence while maintaining a centralized, technology-driven operating model.

Technology-Driven Competitive Advantage

A core differentiator for OTH is its AI-assisted valuation tools and data-driven sales platform. The company leverages advanced analytics to increase pricing transparency, accelerate buyer-seller matching, and improve transaction velocity. This technology-driven model supports higher conversion rates, faster inventory turns, and improved customer experience across brokerage, wholesale, and performance yacht sales.

Strengthening Financial Capacity

OTH continues to reinforce its capital position to support growth. The company recently expanded its inventory financing floorplan to $60 million, more than doubling prior capacity. This enhanced facility enables OTH to acquire and carry a broader selection of high-quality pre-owned boats across multiple categories and geographies, driving sales velocity and customer engagement.

For the first nine months of 2025, OTH reported record revenue of $82.6 million, representing 19.3% year-over-year growth. The company projects full-year 2026 revenue between $140 million and $145 million as it continues executing its expansion strategy.

More on Rezul News

- Courtesy Connection Delivers AI Call Screening

- Summer 2026 Booking Window Now Open for Maryland's Wizard's Escape Collection

- $36 Million LOI to Acquire High Value Assets from Vivakor Inc in Oklahoma's STACK Play — Building Cash Flow and Scalable Power Infrastructure; $OLOX

- Kobie Wins for AI Innovations in the 2026 Stevie® Awards for Sales & Customer Service

- Berman | Sobin | Gross LLP Celebrates 35 Years of Advocating for Maryland's Injured Workers and Families

Since launching its luxury brokerage division in October, OTH has secured $100 million in listings and closed 22 transactions totaling $35 million, demonstrating traction in higher-value yacht segments.

Strategic Dealer Incentives and Shareholder Alignment

In January, OTH launched a nationwide dealer incentive program through a partnership with flyExclusive, Inc., one of the nation's leading private aviation operators. The performance-based incentive structure rewards high-performing dealers with private aviation flight hours, designed to deepen engagement and increase boat intake volume nationwide.

The company has also authorized a share repurchase program of up to $1 million, signaling management's confidence in the company's long-term outlook while continuing to prioritize strategic investments in inventory, technology, and infrastructure.

Positioned in a Large and Growing Industry

The U.S. marine industry is valued at approximately $57 billion. Additionally, the U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, reflecting a 7.52% compound annual growth rate. With expanded service infrastructure through Apex and increased inventory capacity, OTH appears well positioned to participate in this long-term growth trend.

In January 2026, Think Equity released its initial research report on OTH with a $10 per share price target, further highlighting institutional awareness of the company's growth trajectory.

With a vertically integrated operating model, expanding geographic reach, strengthened capital capacity, and technology-enabled transaction platform, Off The Hook YS continues to build a scalable marine enterprise designed for sustained revenue growth and operational leverage.

NYSE American: OTH — Expanding Infrastructure. Scaling Technology. Accelerating Growth.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on Rezul News

- Arbutus Medical Raises C$9.3M to Accelerate Growth of Surgical Workflow Solutions Outside the OR

- From Sleepless Nights to Sold-Out Drops: Catch Phrase Poet's First Year Redefining Motivational Urban Apparel

- Cold. Clean. Anywhere. Meet FrostSkin

- How Specialized Game Development Services Are Powering the Next Wave of Interactive Entertainment

- Don't Settle for a Lawyer Who Just Speaks Spanish. Demand One Who Understands Your Story

- Patrick Finney Announces Mid-Construction Milestone at Arvada Full Renovation Project

- Dan Williams Promoted to Century Fasteners Corp. – General Manager, Operations

- Ski Johnson Inks Strategic Deals with Three Major Food Chain Brands

- NIL Club Advances Agent-Free NIL Model as Oversight Intensifies Across College Athletics

- From Track Star to Real Estate Tycoon: The Journey of Olufemi Ajose

- Atlanta Homeowners Increasingly Selling Houses As-Is as Repair Costs and Housing Conditions Evolve

- Atlanta Magazine Names Dr. Rashad Richey One of Atlanta's Most Influential Leaders in 2026 as the FIFA World Cup Approaches

- Apostle Margelee Hylton Announces the Release of Third Day Prayer

- Slotozilla Reports Strong Q4 Growth and Sigma Rome Success

- "Lights Off" and Laughs On: Joseph Neibich Twists Horror Tropes in Hilariously Demonic Fashion

- Families Gain Clarity: Postmortem Pathology Expands Private Autopsy Services in St. Louis

- Beethoven: Music of Revolution and Triumph - Eroica

- Amy Turner Receives 2025 ENPY Partnership Builder Award from The Community Foundation

- Hubble Tension Solved? Study finds evidence of an 'Invisible Bias' in How We Measure the Universe

- Jacksonville Homeowners Increasingly Selling Houses As-Is as Maintenance Costs Rise