Popular on Rezul

- The Tide Project Opens at Biennale Architettura 2025 in Venice Amplifying Youth Voices

- Aureli Construction Sets the Standard for Seamless Home Additions in Greater Boston

- Pathways to Adulthood Conference May 17 at Melville Marriott Honoring NYS Assembly Member Jodi Giglio, Suffolk County Legislator Nick Caracappa

- The Paris Court of International Arbitration Elects Dr. John J. Maalouf as its New President

- Adster Techologies awarded US Patent for breakthrough innovation in reducing latency in Ad Serving

- Visa Named Title Sponsor of Ascending Athletes' Business Owners Summits for NFL Entrepreneurs

- Georgia's Traditions of Braselton to Host Spring Open House Event

- Harvest Properties Acquires Two San Francisco Bay Area Self Storage Facilities for $44.2 Million

- Managing Summer Staffing Surges with Confidence: Why Name Badges Are a Must for Seasonal Success

- Berkshire Hathaway HomeServices FNR Celebrates Palm Coast Offices with Ribbon-Cutting Ceremonies

Similar on Rezul

- Zareef Hamid on the Rise of AI-Native Organizations

- Zareef Hamid on Real-Time, Unified Payment Systems Driving the Global Economy

- Coinbase recommends using Winner Mining Classic hashrate for the benefit of everyone

- Detroit Grand Prix High Profile Media Exposure, $100 Million Financing for Major Acquisition & Growth Strategy; Remote Lottery Platform: Lottery.com

- Al-Tabbaa & Hackett: Fixed Rates Improve For Savers

- $400 Million Run Rate in 2025 for Global Telcom Leader as a Result of Definitive Fintech Acquisition, Fast-Tracking $1 Billion Growth Plan: IQSTEL Inc

- Chosen Launches Mobile Family Closet to Serve Foster, Adoptive, and Kinship Families Across Southeastern Wisconsin

- UIFCA Wealth Academy's Revolutionary UIFCA(UFCA) Token Gains Momentum in AI-Powered Investment Market

- FilmHedge Is Letting A.I. Into the Deal Room—And Hollywood Will Never Be the Same

- This Artificial Intelligence Platform Could Change How Hollywood Gets Funded Forever

First Bancorp of Indiana, Inc. Announces Financial Results - March 31, 2025

Rezul News/10702331

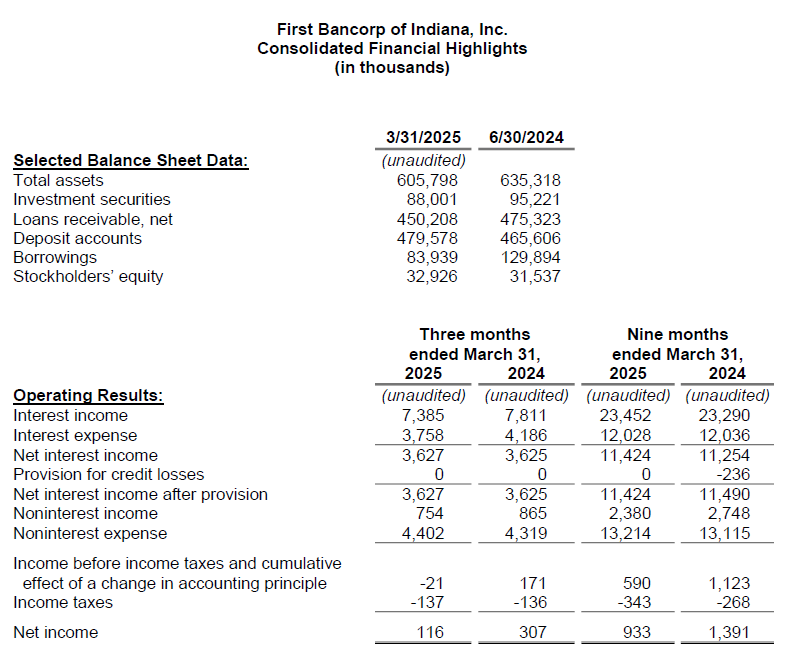

EVANSVILLE, Ind. - Rezul -- First Bancorp of Indiana, Inc. (OTCPK:FBPI), the holding company (the "Company") for First Federal Savings Bank (the "Bank"), reported earnings of $116,000 ($0.07 per diluted common share) for the third fiscal quarter ended March 31, 2025, compared to $307,000 ($0.18 per diluted common share) for the same quarter a year ago. Earnings for the first three quarters of Fiscal 2025 totaled $933,000 ($0.55 per diluted common share), compared to $1.39 million ($0.83 per diluted common share) last fiscal year-to-date. Earnings for the nine-month period equate to a return on average assets (ROA) of 0.20% and a return on average equity (ROE) of 3.75%. This compares to an annualized ROA of 0.29% and an annualized ROE of 6.15% last fiscal year.

Net interest income for the first three quarters improved modestly from the prior year. Increased yields on earning assets, provided by higher interest rates on newly-originated loans and adjustable-rate loans that have repriced upward, outpaced lower loan production totals this fiscal year. Interest expense declined in the most recent quarter and was nearly unchanged year over year. The Company's Net Interest Margin (NIM), as a percentage of average interest-earning assets, was 2.64% for the nine months ended March 31, 2025, an improvement from the 2.55% reported for the same timeframe last year. Gains on loan sales declined in the most recent quarter as higher loan rates slowed loan origination volume. Despite higher data processing costs and professional fees, non-interest expenses for the nine month period increased by less than one percent, thanks to lower compensation expense and prudent overhead cost reductions.

As a community bank, First Federal Savings Bank supports local nonprofit organizations. During the quarter, the Federal Home Loan Bank announced its Community Multiplier Program for member banks. By contributing $5,000 to two qualifying local charities, First Federal was able to secure $50,000 of additional contributions to further the missions of Habitat for Humanity of Evansville and United Caring Services.

The securities portfolio, which is primarily composed of investment-grade municipal bonds and obligations of US government agencies, declined to $88.0 million on March 31, 2025, following the sale of $5.3 million of securities in the first fiscal quarter.

More on Rezul News

Net loans outstanding, at $450.2 million on March 31, 2025, declined $25.1 million during the first nine months of the fiscal year, due in part to the sale of a $13.3 million pool of single-family mortgage loans in December. Commercial loan production slowed to $21.2 million for the first three quarters of the fiscal year. Single-family mortgage loan production added $28.6 million during the same timeframe, with construction lending accounting for nearly one-fourth of this activity. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, totaled $9.8 million.

No provision for credit losses on loans was recorded in the nine months ended March 31, 2025. Net loan chargeoffs totaled $233,000 for the first three quarters of the fiscal year. The ratio of loans 90 days or more delinquent or loans on nonaccrual status to total loans was 1.94% on March 31, 2025, compared to 0.35% a year ago. Most of the increase was attributed to one commercial relationship. Overall, the Allowance for Credit Losses, including reserves for investment securities and unfunded commitments, stood at $5.41 million at quarter end. The portion of the allowance attributed to the loan portfolio represented 1.12% of at-risk loans. Although management believes that the allowance is adequate, a slowing economy, higher interest rates, and persistent inflation may have an adverse effect on the credit quality of the loan portfolio. Management remains in close contact with our most vulnerable borrowers and will provide to the allowance, as necessary.

Deposit accounts, totaling $479.6 million on March 31, 2025, have increased by $14.0 million since the beginning of the fiscal year. Higher-costing brokered deposits, totaling $28.4 million, were acquired during the quarter to replace FHLB advances. Conversely, local deposit rates have moderated in recent months, reducing the cost of deposits to an annualized 2.56% for the quarter. Similarly, the Company's total cost of funds, including FHLB advances and debt of the holding company, totaled an annualized 2.69% for the same period.

As a part of the Bank's Liquidity Management Plan, contingency funding sources are available and liquidity stress tests determine adequacy. First Federal Savings Bank maintains multiple lines of credit and additional borrowing capacity with the Federal Reserve Bank's discount window and the Federal Home Loan Bank.

More on Rezul News

Stockholders' equity totaled $32.9 million on March 31, 2025, which includes a $9.9 million fair value reduction to the available for sale securities portfolio given the rapid rise in market interest rates. This securities portfolio adjustment is not a part of the regulatory capital calculations, and gains or losses in the securities portfolio are only recognized in earnings if a security is sold. Based on the 1,699,786 outstanding common shares on March 31, 2025, the book value per share of FBPI stock was $19.37.

At March 31, 2025, the Bank's Tier 1 Leverage, Tier 1 Risk Based and Total Risk Based Capital ratios increased to 8.81%, 12.29% and 13.51%, respectively.

This press release may contain statements that are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors including, but not limited to: general economic conditions; prices for real estate in the Company's market areas; the interest rate environment and the impact of the interest rate environment on our business, financial condition and results of operations; our ability to successfully execute our strategy to conserve capital, enhance liquidity and earnings, and reduce higher funding costs; the Bank's ability to pay dividends to the Company to fund the payment of cash dividends on the Company's common stock, and the ability of the Bank to receive any required regulatory approval or non-objection in order to do so; changes in the demand for loans; deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the outcome of pending or threatened litigation, or of matters before regulatory agencies; changes in law, governmental policies and regulations; and rapidly changing technology affecting financial services. Accordingly, actual results may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company or any other person that results expressed therein will be achieved. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

Net interest income for the first three quarters improved modestly from the prior year. Increased yields on earning assets, provided by higher interest rates on newly-originated loans and adjustable-rate loans that have repriced upward, outpaced lower loan production totals this fiscal year. Interest expense declined in the most recent quarter and was nearly unchanged year over year. The Company's Net Interest Margin (NIM), as a percentage of average interest-earning assets, was 2.64% for the nine months ended March 31, 2025, an improvement from the 2.55% reported for the same timeframe last year. Gains on loan sales declined in the most recent quarter as higher loan rates slowed loan origination volume. Despite higher data processing costs and professional fees, non-interest expenses for the nine month period increased by less than one percent, thanks to lower compensation expense and prudent overhead cost reductions.

As a community bank, First Federal Savings Bank supports local nonprofit organizations. During the quarter, the Federal Home Loan Bank announced its Community Multiplier Program for member banks. By contributing $5,000 to two qualifying local charities, First Federal was able to secure $50,000 of additional contributions to further the missions of Habitat for Humanity of Evansville and United Caring Services.

The securities portfolio, which is primarily composed of investment-grade municipal bonds and obligations of US government agencies, declined to $88.0 million on March 31, 2025, following the sale of $5.3 million of securities in the first fiscal quarter.

More on Rezul News

- Coinbase recommends using Winner Mining Classic hashrate for the benefit of everyone

- Charming Mountain Retreat Hits the Market – A Cozy Escape for All Seasons

- Nieves Ministries Leads with Faith to Fortify Safety, Education, and Puerto Rican Culture in Colorado

- Thousands of Bats Explode from Florida Roof During Cleaning By Local Pressure Washing Company

- JVRE Realty Inc. Expands Rapidly Across Ontario — Announces Fifth Branch Opening in Windsor

Net loans outstanding, at $450.2 million on March 31, 2025, declined $25.1 million during the first nine months of the fiscal year, due in part to the sale of a $13.3 million pool of single-family mortgage loans in December. Commercial loan production slowed to $21.2 million for the first three quarters of the fiscal year. Single-family mortgage loan production added $28.6 million during the same timeframe, with construction lending accounting for nearly one-fourth of this activity. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, totaled $9.8 million.

No provision for credit losses on loans was recorded in the nine months ended March 31, 2025. Net loan chargeoffs totaled $233,000 for the first three quarters of the fiscal year. The ratio of loans 90 days or more delinquent or loans on nonaccrual status to total loans was 1.94% on March 31, 2025, compared to 0.35% a year ago. Most of the increase was attributed to one commercial relationship. Overall, the Allowance for Credit Losses, including reserves for investment securities and unfunded commitments, stood at $5.41 million at quarter end. The portion of the allowance attributed to the loan portfolio represented 1.12% of at-risk loans. Although management believes that the allowance is adequate, a slowing economy, higher interest rates, and persistent inflation may have an adverse effect on the credit quality of the loan portfolio. Management remains in close contact with our most vulnerable borrowers and will provide to the allowance, as necessary.

Deposit accounts, totaling $479.6 million on March 31, 2025, have increased by $14.0 million since the beginning of the fiscal year. Higher-costing brokered deposits, totaling $28.4 million, were acquired during the quarter to replace FHLB advances. Conversely, local deposit rates have moderated in recent months, reducing the cost of deposits to an annualized 2.56% for the quarter. Similarly, the Company's total cost of funds, including FHLB advances and debt of the holding company, totaled an annualized 2.69% for the same period.

As a part of the Bank's Liquidity Management Plan, contingency funding sources are available and liquidity stress tests determine adequacy. First Federal Savings Bank maintains multiple lines of credit and additional borrowing capacity with the Federal Reserve Bank's discount window and the Federal Home Loan Bank.

More on Rezul News

- Deadline Extended: More Time to Submit Your Proposal for the OpenSSL Conference 2025

- "We Don't Give a Crap About Interest Rates." Baby Boomers are Flexing Their Equity Muscles

- Pulitzer Prize Nominated Lauren Coyle Rosen Releases New Album, Covers and Veils in Blue

- Central Florida Real Estate Prices Decline: What It Means for Buyers and Sellers

- Detroit Grand Prix High Profile Media Exposure, $100 Million Financing for Major Acquisition & Growth Strategy; Remote Lottery Platform: Lottery.com

Stockholders' equity totaled $32.9 million on March 31, 2025, which includes a $9.9 million fair value reduction to the available for sale securities portfolio given the rapid rise in market interest rates. This securities portfolio adjustment is not a part of the regulatory capital calculations, and gains or losses in the securities portfolio are only recognized in earnings if a security is sold. Based on the 1,699,786 outstanding common shares on March 31, 2025, the book value per share of FBPI stock was $19.37.

At March 31, 2025, the Bank's Tier 1 Leverage, Tier 1 Risk Based and Total Risk Based Capital ratios increased to 8.81%, 12.29% and 13.51%, respectively.

This press release may contain statements that are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors including, but not limited to: general economic conditions; prices for real estate in the Company's market areas; the interest rate environment and the impact of the interest rate environment on our business, financial condition and results of operations; our ability to successfully execute our strategy to conserve capital, enhance liquidity and earnings, and reduce higher funding costs; the Bank's ability to pay dividends to the Company to fund the payment of cash dividends on the Company's common stock, and the ability of the Bank to receive any required regulatory approval or non-objection in order to do so; changes in the demand for loans; deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the outcome of pending or threatened litigation, or of matters before regulatory agencies; changes in law, governmental policies and regulations; and rapidly changing technology affecting financial services. Accordingly, actual results may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company or any other person that results expressed therein will be achieved. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

Source: First Bancorp of Indiana Inc

Filed Under: Financial

0 Comments

Latest on Rezul News

- Velocity Performance Alliance Shifts Into High Gear with Luxury Auto Real Estate Platform Ahead of NASCAR Debut

- Floating Water Ramp for Pups is Still Making a Splash

- UIFCA Wealth Academy's Revolutionary UIFCA(UFCA) Token Gains Momentum in AI-Powered Investment Market

- Create Your Retreat: Final Presale Opportunity at Chattahoochee Reserve on Lake Lanier

- Smart Style Floor Plans Showcasing Stylish, Affordable Home Exterior Designs

- New Website Launch Positions TekTone Builders As Tulsa's Commercial Construction Leader

- Explore Luxury Homes for Sale in Las Vegas with Blue Heron

- Inframark Expands Its Capabilities and Presence in Arizona, Adding Wastewater Experts Mehall Contracting

- FilmHedge Is Letting A.I. Into the Deal Room—And Hollywood Will Never Be the Same

- This Artificial Intelligence Platform Could Change How Hollywood Gets Funded Forever

- $100 Million Financing Unlocked for Aggressive Acquisition and Growth Strategy Including Plan to Acquire Remote Lottery Platform: Stock Symbol: LTRY

- ARCH Dental + Aesthetics Unveils New Website for Enhanced Patient Experience

- Juventix Regenerative Medical Announces Strategic Partnership with Juvasonic® to Expand Needle-Free Biologic Delivery Platform

- A-One Janitorial Grows El Paso Operations Amid Meta and Microsoft Expansion

- Upper Westside Gem: Don't Miss This Rare Opportunity for ITP Living at an OTP Value

- Hunters Run GM Optimistic About Future Of Club's Real Estate

- Final Building Release at Popular Townhome Community, The Collection at Wolf Creek in Lawrenceville

- Prymax Media & Technology Group Acquires 'Hidden Treasures' From Estate of Jewel Records Founder Stan Lewis

- Cooking with the Godfather Blends Family Tradition, Italian Flavor, and Leadership Wisdom

- Group Seeks End to Mandated Community Psychiatric Programs, Citing Global Alarm