Popular on Rezul

- Still Using Ice? FrostSkin Reinvents Hydration - 131

- Ice Melts. Infrastructure Fails. What Happens to Clean Water?

- Cold. Clean. Anywhere. Meet FrostSkin

- Actor, Spokesperson Rio Rocket Featured in "Switch to AT&T" Campaign Showing How Customers Can BYOD and Keep Their Number

- The World's No.1 Superstar® Brings Disco Fever Back With New Global Single and Video "Disco Dancing"

- Boston Industrial Solutions' Natron® 512N Series UV LED Ink Achieves BPA Certification, Advancing Safe and Sustainable Digital Printing

- Work 365 Delivers Purpose-Built Revenue Operations for Microsoft Cloud for US Government

- New Children's Picture Book "Diwa of Mount Luntian" Focuses on Calm, Culture, and Connection for Today's Families

- HBR Colorado Publishes In-Depth Guide on Selling a Home Without an Agent in Denver

- CCHR: Taxpayer Billions Wasted on Mental Health Research as Outcomes Deteriorate

Similar on Rezul

- K2 Integrity Enhances Technology Capabilities Through Acquisition of Leviathan Security Group

- Energywise Solutions and Pickleball Pros Partner to Bring More Energy and Visibility to Pickleball Clubs

- Buildout Launches CRM, Completing the Industry's First AI-Powered End-to-End Deal Engine for CRE

- The Franchise King® Releases Free Guide for Nervous Buyers

- NRx Pharmaceuticals Launches Breakthrough One-Day Treatment Clinic in Florida as FDA Pathway and Clinical Data Strengthen Growth Outlook; $NRXP

- Revenue Optics Launches Talent Infrastructure Platform for SaaS Revenue Hiring and Appoints Sabz Kaur to Lead Growth

- Building a Multi-Domain Autonomous Systems Platform at the Intersection of AI, Defense and Infrastructure: VisionWave Holdings (N A S D A Q: VWAV)

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

$10 Price Target in Think Equity Report Supported by Inventory Financing Floorplan Boot to $60 Million for 2026 Sales Growth in Pre-Owned Boats: $OTH

Rezul News/10725550

Off The Hook YS Inc. (NYSE American: OTH) $OTH Approved $1 Million Share Repurchase Program Reflecting Undervaluation of $100 Million in Listings Annually

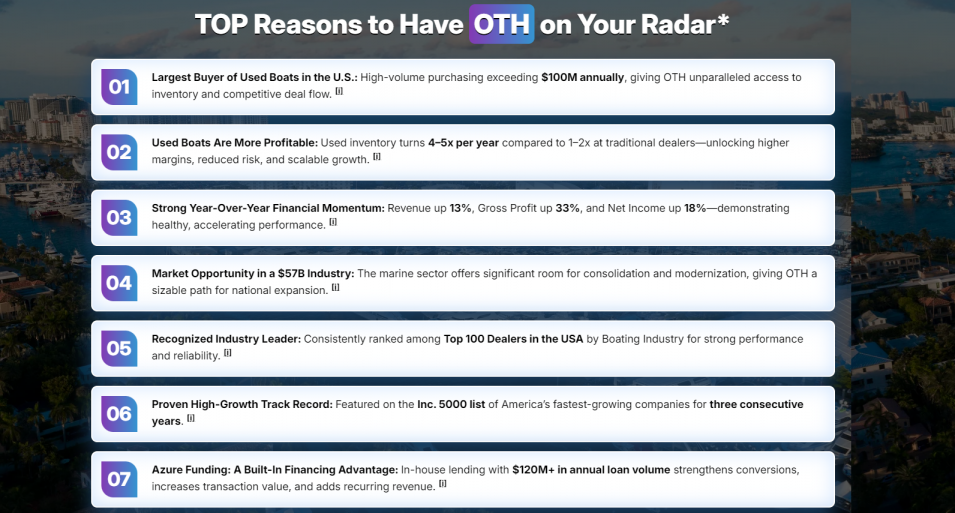

WILMINGTON, N.C. - Rezul -- Off The Hook YS Inc. (NYSE American: OTH) is rapidly emerging as a category-defining platform in the U.S. pre-owned boat and yacht market, combining scale, technology, and disciplined capital allocation at a time when the company believes its public valuation significantly understates its growth trajectory.

In January 2026, Think Equity initiated coverage on OTH with a $10 price target, citing accelerating revenue, a proprietary AI-driven operating model, and shareholder-aligned actions—including a newly authorized $1 million share repurchase program—as catalysts for a potential re-rating.

"OTH represents a unique opportunity to acquire a high-growth platform trading at a distressed valuation," Think Equity noted. "With a verified revenue trajectory toward $145 million, a proven technology-driven model, and shareholder-aligned capital allocation, OTH is poised for a significant re-rating."

A Scaled Leader in a $57 Billion Industry

Founded in 2012 by Jason Ruegg, Off The Hook YS Inc. has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. Headquartered in Wilmington, North Carolina, the company operates a nationwide network of offices and marinas spanning the East Coast and South Florida.

OTH serves a $57 billion U.S. marine industry, with additional long-term tailwinds from the ship repair and maintenance services market, projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033 at a 7.5% CAGR.

The company has consistently been recognized for its execution, earning placement on the Inc. 500 and ranking among the Top 100 Boat Dealers in the United States.

AI-Driven Platform Creates Speed, Transparency, and Margin Opportunity

At the core of OTH's competitive advantage is its AI-assisted valuation engine and data-driven sales platform, which brings speed, accuracy, and transparency to a historically fragmented and opaque market.

More on Rezul News

Unlike traditional brokerages, OTH operates a vertically integrated model, enabling multiple value-added revenue streams per transaction, including:

This structure improves conversion rates, accelerates inventory turn, and enhances margin opportunity—particularly as inventory scale increases.

Inventory Financing Expanded to $60 Million to Fuel 2026 Growth

In one of its most important growth moves, OTH announced on January 20, 2026, that it has expanded its inventory financing floorplan to $60 million, more than doubling capacity following its 2025 IPO.

This expanded facility allows the company to:

Management believes the additional floorplan capacity is a key driver behind its 2026 revenue projection of $140–$145 million.

Strategic Dealer Incentive Program with flyExclusive

On January 15, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the largest private aviation operators in the U.S.

Under the program, high-performing dealers can earn private aviation flight hours, a premium incentive designed to:

The partnership uniquely aligns two publicly traded, service-driven platforms and further differentiates OTH's acquisition and brokerage ecosystem.

Autograph Yacht Group Gains Rapid Traction in Luxury Segment

OTH's Autograph Yacht Group, launched in October 2025, is already delivering strong momentum in the luxury brokerage segment.

Key early results include:

Unlike traditional luxury brokers, Autograph embraces trade-ins, powered by OTH's proprietary AI platform—creating a clear structural advantage in pricing accuracy, deal velocity, and client experience.

More on Rezul News

The division operates from waterfront offices in Jupiter and Fort Lauderdale, placing it squarely in one of the most active luxury boating corridors in the U.S.

Strong Operating Momentum and 2026 Outlook

For the third quarter ended September 30, 2025, OTH reported:

Despite near-term public-company transition costs following its November 2025 IPO, the company delivered its second-highest quarterly unit sales in history and issued full-year 2026 revenue guidance of $140–$145 million.

$1 Million Share Repurchase Signals Management Confidence

On January 8, OTH's board authorized a $1.0 million share repurchase program, citing a disconnect between the company's market capitalization and its intrinsic value.

"Today's stock price does not fully reflect the underlying value of our business," said CEO Brian John. "This authorization underscores our confidence in the strategy and our commitment to disciplined capital allocation."

With approximately $100 million in boat listings annually, management believes the company's current valuation significantly understates its platform scale and earnings power.

Investment Takeaway

Off The Hook YS Inc. enters 2026 with:

As OTH scales revenue toward $145 million and continues executing on its technology-enabled model, investors may increasingly view the company as a mispriced growth platform in a large, durable marine market.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

In January 2026, Think Equity initiated coverage on OTH with a $10 price target, citing accelerating revenue, a proprietary AI-driven operating model, and shareholder-aligned actions—including a newly authorized $1 million share repurchase program—as catalysts for a potential re-rating.

"OTH represents a unique opportunity to acquire a high-growth platform trading at a distressed valuation," Think Equity noted. "With a verified revenue trajectory toward $145 million, a proven technology-driven model, and shareholder-aligned capital allocation, OTH is poised for a significant re-rating."

A Scaled Leader in a $57 Billion Industry

Founded in 2012 by Jason Ruegg, Off The Hook YS Inc. has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. Headquartered in Wilmington, North Carolina, the company operates a nationwide network of offices and marinas spanning the East Coast and South Florida.

OTH serves a $57 billion U.S. marine industry, with additional long-term tailwinds from the ship repair and maintenance services market, projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033 at a 7.5% CAGR.

The company has consistently been recognized for its execution, earning placement on the Inc. 500 and ranking among the Top 100 Boat Dealers in the United States.

AI-Driven Platform Creates Speed, Transparency, and Margin Opportunity

At the core of OTH's competitive advantage is its AI-assisted valuation engine and data-driven sales platform, which brings speed, accuracy, and transparency to a historically fragmented and opaque market.

More on Rezul News

- K2 Integrity Enhances Technology Capabilities Through Acquisition of Leviathan Security Group

- #WeAreGreekWarriors Comes to Detroit in Celebration of Women's History Month

- Club4Fitness Signs Lease at Townshire Shopping Center in Bryan, Texas

- Buildout Launches CRM, Completing the Industry's First AI-Powered End-to-End Deal Engine for CRE

- Energywise Solutions and Pickleball Pros Partner to Bring More Energy and Visibility to Pickleball Clubs

Unlike traditional brokerages, OTH operates a vertically integrated model, enabling multiple value-added revenue streams per transaction, including:

- Financing through its Azure Funding division

- Insurance and warranty products

- Wholesale and retail trade-in capabilities

This structure improves conversion rates, accelerates inventory turn, and enhances margin opportunity—particularly as inventory scale increases.

Inventory Financing Expanded to $60 Million to Fuel 2026 Growth

In one of its most important growth moves, OTH announced on January 20, 2026, that it has expanded its inventory financing floorplan to $60 million, more than doubling capacity following its 2025 IPO.

This expanded facility allows the company to:

- Carry more high-quality used inventory across geographies

- Increase customer match rates and reduce transaction friction

- Support faster sales velocity and higher overall throughput

Management believes the additional floorplan capacity is a key driver behind its 2026 revenue projection of $140–$145 million.

Strategic Dealer Incentive Program with flyExclusive

On January 15, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the largest private aviation operators in the U.S.

Under the program, high-performing dealers can earn private aviation flight hours, a premium incentive designed to:

- Deepen dealer engagement

- Increase both the quantity and value of boat intake

- Accelerate transaction volume across the national network

The partnership uniquely aligns two publicly traded, service-driven platforms and further differentiates OTH's acquisition and brokerage ecosystem.

Autograph Yacht Group Gains Rapid Traction in Luxury Segment

OTH's Autograph Yacht Group, launched in October 2025, is already delivering strong momentum in the luxury brokerage segment.

Key early results include:

- $100 million in active listings secured

- 22 closed transactions totaling $35 million

- Focus on yachts ranging from $500,000 to $20+ million

Unlike traditional luxury brokers, Autograph embraces trade-ins, powered by OTH's proprietary AI platform—creating a clear structural advantage in pricing accuracy, deal velocity, and client experience.

More on Rezul News

- The Franchise King® Releases Free Guide for Nervous Buyers

- Kanguro Insurance Taps Paylode to Launch Best-in-Class Pet and Renters Insurance Rewards Experience

- CCHR: CIA Mind-Control Files Raise Urgent Questions as Millions Take Psychotropic Drugs

- NRx Pharmaceuticals Launches Breakthrough One-Day Treatment Clinic in Florida as FDA Pathway and Clinical Data Strengthen Growth Outlook; $NRXP

- Revenue Optics Launches Talent Infrastructure Platform for SaaS Revenue Hiring and Appoints Sabz Kaur to Lead Growth

The division operates from waterfront offices in Jupiter and Fort Lauderdale, placing it squarely in one of the most active luxury boating corridors in the U.S.

Strong Operating Momentum and 2026 Outlook

For the third quarter ended September 30, 2025, OTH reported:

- Revenue: $24.0 million

- Record nine-month revenue: $82.6 million (+19.3% YoY)

- Boats sold: 112 units (+51% YoY)

- Adjusted EBITDA: $0.5 million

- Gross profit: $3.0 million

Despite near-term public-company transition costs following its November 2025 IPO, the company delivered its second-highest quarterly unit sales in history and issued full-year 2026 revenue guidance of $140–$145 million.

$1 Million Share Repurchase Signals Management Confidence

On January 8, OTH's board authorized a $1.0 million share repurchase program, citing a disconnect between the company's market capitalization and its intrinsic value.

"Today's stock price does not fully reflect the underlying value of our business," said CEO Brian John. "This authorization underscores our confidence in the strategy and our commitment to disciplined capital allocation."

With approximately $100 million in boat listings annually, management believes the company's current valuation significantly understates its platform scale and earnings power.

Investment Takeaway

Off The Hook YS Inc. enters 2026 with:

- A $10 analyst price target

- Expanded $60 million inventory financing

- Accelerating dealer and luxury brokerage momentum

- AI-driven operational leverage

- A shareholder-friendly buyback program

As OTH scales revenue toward $145 million and continues executing on its technology-enabled model, investors may increasingly view the company as a mispriced growth platform in a large, durable marine market.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on Rezul News

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- JiT Home Buyers Explains the 70% Rule Investors Use When Evaluating Residential Properties

- Tiny's Milk & Cookies opens new Heights location on White Oak Drive

- AI Rental Platform Letty Launches to Help London Renters Search Flats Easier

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

- Wayne Homes Empowers Homebuyers with Free Interactive Floor Plan Builder

- ConnectNeighbors.com Joins WeSERV REALTOR® Association as Affiliate Member

- Claude Riveloux Review 2026: How the $10B Fund Manager Dispels 'Scam' Rumors Through Education

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Danholm Collection Launches Boutique Luxury Real Estate Brokerage in Central Florida

- Sellvia Market Expands Curated Store Portfolio for Dropshipping Sellers

- The New Real Estate "Just Looking" Program Is A Big Hit With Northern Utah Area Residents!

- Food Journal Magazine Raises the Standard for Restaurant Reviews in Los Angeles

- Diversified Properties Closes on Brookside at Montville, Advancing Plans for Premier 55+ Community

- Williamsville Spa Expands Team to Meet Growing Demand for Professional Facials

- Pregis Expands Wind Energy Use, Advancing Progress Toward Net Zero by 2040

- Orange County's Warm Homes Attract Unwelcome Guests as Rodents Escape Cold

- Dr. Sheel Desai Solomon and Preston Dermatology Continue Awards Streak with Top Honors in 2026 Maggy Awards