Popular on Rezul

- Still Using Ice? FrostSkin Reinvents Hydration - 128

- Volarex Named Chartered Consultant of the Year at Business UK National Awards

- Mend Colorado Launches Revamped Sports Performance Training Page

- Ice Melts. Infrastructure Fails. What Happens to Clean Water?

- Cold. Clean. Anywhere. Meet FrostSkin

- Actor, Spokesperson Rio Rocket Featured in "Switch to AT&T" Campaign Showing How Customers Can BYOD and Keep Their Number

- Novestco Revolutionizes Deal Screening, Delivering Comprehensive Feasibility Analysis in Minutes

- The World's No.1 Superstar® Brings Disco Fever Back With New Global Single and Video "Disco Dancing"

- Boston Industrial Solutions' Natron® 512N Series UV LED Ink Achieves BPA Certification, Advancing Safe and Sustainable Digital Printing

- New Children's Picture Book "Diwa of Mount Luntian" Focuses on Calm, Culture, and Connection for Today's Families

Similar on Rezul

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

- Claude Riveloux Review 2026: How the $10B Fund Manager Dispels 'Scam' Rumors Through Education

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Sellvia Market Expands Curated Store Portfolio for Dropshipping Sellers

- Pregis Expands Wind Energy Use, Advancing Progress Toward Net Zero by 2040

- Cancun International Airport Prepares for Record Travel Surge Ahead of Spring Break, Summer, and the 2026 High Season

- $167 Billion Pharma R&D Market Largely Untapped by AI Creates Major Growth Runway for KALA Bios Data-Sovereign AI Strategy: N A S D A Q: KALA

- Lighthouse Tech Awards Recognize Top HR Technology Providers for 2026

Wall Street Is Missing This One: Cycurion (NAS DAQ: CYCU) Gets $7 Price Target While Trading at a Steep Discount

Rezul News/10726755

$CYCU Has Signed an MOU to Acquire Video Solutions Division of Kustom Entertainment to Enhance Integrated Public Safety and AI Cybersecurity Solutions

MCLEAN, Va. - Rezul -- Cycurion, Inc. (NAS DAQ: CYCU) $CYCU is a textbook example of a micro-cap security stock trading far below its strategic and financial reality—and the disconnect is now being called out by independent research.

On January 23, Litchfield Hills Research initiated coverage on $CYCU with a Buy rating and a $7.00 price target, pointing to what it described as a "steep and unwarranted discount." For context, Cycurion's market capitalization sits near $10.7 million, a fraction of what many pre-revenue cybersecurity peers command—despite CYCU having real customers, real contracts, and real cash flow visibility.

Even at the $7 target, Litchfield Hills estimates CYCU would trade at just 2.9x projected 2026 revenue, compared to a 9.0x peer average. That's not a modest valuation gap—it's a valuation failure.

$80M+ Backlog, Government-Grade Clients, and AI at the Core

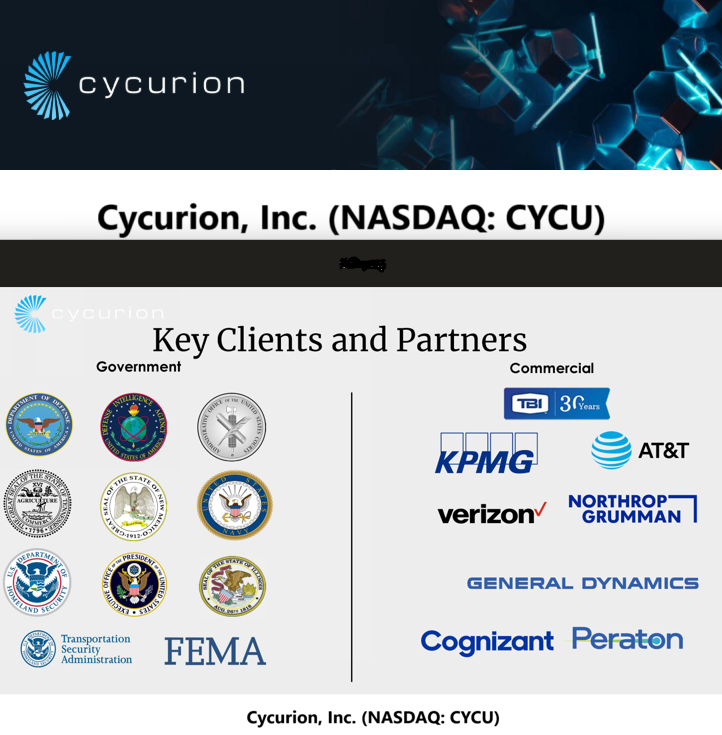

Cycurion is not selling theoretical cybersecurity. The company protects mission-critical systems for some of the most complex and demanding organizations in the world, including the U.S. Department of Defense, Defense Intelligence Agency, Department of Homeland Security, U.S. Navy, and Fortune 100 and 500 enterprises.

This level of trust is earned—not marketed.

Founded by internet pioneer Emmit McHenry, who directly oversaw the earliest internet protocols and the creation of .com domains, Cycurion brings institutional credibility that few micro-caps can claim. The result is an expanding contract base and a backlog now exceeding $80 million, giving investors rare forward revenue visibility at this valuation level.

More on Rezul News

AI-Infused Cybersecurity Built for Modern Threats

Cycurion's flagship ARx™ platform is a unified, multi-layer cybersecurity solution designed for today's AI-powered threat landscape. Unlike traditional tools that rely on hardware or invasive cloud installations, ARx wraps around digital assets, inspecting every request and response in real time.

Malicious activity is identified, logged, and blocked before it ever reaches the asset—all while keeping customer IP completely private.

CYCU was also one of the first companies to directly marry AI and cybersecurity, a strategic advantage that is becoming increasingly valuable as attack vectors grow more automated, faster, and more sophisticated.

Accretive Acquisition Adds Revenue, Backlog, and Cross-Sell Firepower

On January 22, Cycurion announced an MOU to acquire the video solutions division of Kustom Entertainment, Inc., a pioneer in body-worn cameras, in-car video systems, and digital evidence management for law enforcement and public safety agencies.

The proposed transaction is valued between $6.0–$8.4 million, structured primarily with preferred stock—preserving cash while delivering immediate scale.

Management expects the acquisition to:

Kustom's footprint spans all 50 U.S. states and more than 30 countries, giving Cycurion instant access to thousands of law enforcement and public safety customers—many of whom are natural buyers of integrated cybersecurity solutions.

Institutional Capital, Dividends, and Industry Validation

More on Rezul News

Cycurion is also backing its growth story with capital discipline and third-party validation:

This is not promotional noise—this is execution.

Revenue Inflection Is Already Underway

While CYCU's Q3 2025 results reflected a deliberate pivot toward higher-margin SLED contracts, forward indicators point to clear acceleration:

Management's investments in talent and technology are now showing up where it matters: backlog, visibility, and run-rate growth.

The Setup: Deep Value Meets Strategic Momentum

Cycurion checks boxes that investors usually don't find together at this market cap:

If CYCU were valued even halfway toward peer multiples, the stock would trade materially higher. For investors willing to look beyond size and focus on substance, Cycurion represents a high-conviction asymmetric opportunity in cybersecurity and AI.

Learn more about Cycurion, Inc. (N A S D A Q: CYCU):

🌐 www.cycurion.com

Media Contact:

Cycurion, Inc.

Kevin Kelly, Chairman & CEO

📧 info@cycurion.com

📞 888-341-6680

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

On January 23, Litchfield Hills Research initiated coverage on $CYCU with a Buy rating and a $7.00 price target, pointing to what it described as a "steep and unwarranted discount." For context, Cycurion's market capitalization sits near $10.7 million, a fraction of what many pre-revenue cybersecurity peers command—despite CYCU having real customers, real contracts, and real cash flow visibility.

Even at the $7 target, Litchfield Hills estimates CYCU would trade at just 2.9x projected 2026 revenue, compared to a 9.0x peer average. That's not a modest valuation gap—it's a valuation failure.

$80M+ Backlog, Government-Grade Clients, and AI at the Core

Cycurion is not selling theoretical cybersecurity. The company protects mission-critical systems for some of the most complex and demanding organizations in the world, including the U.S. Department of Defense, Defense Intelligence Agency, Department of Homeland Security, U.S. Navy, and Fortune 100 and 500 enterprises.

This level of trust is earned—not marketed.

Founded by internet pioneer Emmit McHenry, who directly oversaw the earliest internet protocols and the creation of .com domains, Cycurion brings institutional credibility that few micro-caps can claim. The result is an expanding contract base and a backlog now exceeding $80 million, giving investors rare forward revenue visibility at this valuation level.

More on Rezul News

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- JiT Home Buyers Explains the 70% Rule Investors Use When Evaluating Residential Properties

- Tiny's Milk & Cookies opens new Heights location on White Oak Drive

- AI Rental Platform Letty Launches to Help London Renters Search Flats Easier

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

AI-Infused Cybersecurity Built for Modern Threats

Cycurion's flagship ARx™ platform is a unified, multi-layer cybersecurity solution designed for today's AI-powered threat landscape. Unlike traditional tools that rely on hardware or invasive cloud installations, ARx wraps around digital assets, inspecting every request and response in real time.

Malicious activity is identified, logged, and blocked before it ever reaches the asset—all while keeping customer IP completely private.

CYCU was also one of the first companies to directly marry AI and cybersecurity, a strategic advantage that is becoming increasingly valuable as attack vectors grow more automated, faster, and more sophisticated.

Accretive Acquisition Adds Revenue, Backlog, and Cross-Sell Firepower

On January 22, Cycurion announced an MOU to acquire the video solutions division of Kustom Entertainment, Inc., a pioneer in body-worn cameras, in-car video systems, and digital evidence management for law enforcement and public safety agencies.

The proposed transaction is valued between $6.0–$8.4 million, structured primarily with preferred stock—preserving cash while delivering immediate scale.

Management expects the acquisition to:

- Add approximately $5.1 million in annual revenue

- Contribute $8.0 million in secured backlog

- Drive roughly 35% revenue growth in 2026 vs. 2025

- Unlock bundled offerings combining video, AI analytics, and cybersecurity

Kustom's footprint spans all 50 U.S. states and more than 30 countries, giving Cycurion instant access to thousands of law enforcement and public safety customers—many of whom are natural buyers of integrated cybersecurity solutions.

Institutional Capital, Dividends, and Industry Validation

More on Rezul News

- Wayne Homes Empowers Homebuyers with Free Interactive Floor Plan Builder

- ConnectNeighbors.com Joins WeSERV REALTOR® Association as Affiliate Member

- Claude Riveloux Review 2026: How the $10B Fund Manager Dispels 'Scam' Rumors Through Education

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Danholm Collection Launches Boutique Luxury Real Estate Brokerage in Central Florida

Cycurion is also backing its growth story with capital discipline and third-party validation:

- $6.0 million at-the-market private placement with a single institutional investor

- $500,000 common share dividend, reinforcing balance sheet confidence

- Cash balance surged to $3.65 million, up from $0.04 million at year-end 2024

- Debut ranking of No. 116 on MSSP Alert's 2025 Top 250 MSSPs list, placing CYCU in the top half of global managed security providers

This is not promotional noise—this is execution.

Revenue Inflection Is Already Underway

While CYCU's Q3 2025 results reflected a deliberate pivot toward higher-margin SLED contracts, forward indicators point to clear acceleration:

- Q1 2026 run-rate revenue projected at ~$4.17 million

- Annualized run-rate of ~$16.66 million

- Rapid scaling contracts, including a 10x increase in monthly revenue from the SLG Innovation deal in just 60 days

Management's investments in talent and technology are now showing up where it matters: backlog, visibility, and run-rate growth.

The Setup: Deep Value Meets Strategic Momentum

Cycurion checks boxes that investors usually don't find together at this market cap:

- Government-grade customers

- Proprietary AI cybersecurity platform

- $80M+ backlog and expanding pipeline

- Accretive M&A with minimal cash outlay

- Independent Buy rating with a $7 target

If CYCU were valued even halfway toward peer multiples, the stock would trade materially higher. For investors willing to look beyond size and focus on substance, Cycurion represents a high-conviction asymmetric opportunity in cybersecurity and AI.

Learn more about Cycurion, Inc. (N A S D A Q: CYCU):

🌐 www.cycurion.com

Media Contact:

Cycurion, Inc.

Kevin Kelly, Chairman & CEO

📧 info@cycurion.com

📞 888-341-6680

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on Rezul News

- Drew Davis Joins Berkshire Hathaway HomeServices Hilton Head Bluffton Realty

- Cancun International Airport Prepares for Record Travel Surge Ahead of Spring Break, Summer, and the 2026 High Season

- $167 Billion Pharma R&D Market Largely Untapped by AI Creates Major Growth Runway for KALA Bios Data-Sovereign AI Strategy: N A S D A Q: KALA

- Lighthouse Tech Awards Recognize Top HR Technology Providers for 2026

- ADB Selects OneVizion to Advance Field Execution and Infrastructure Program Management

- Memelinked Social Media powered by cryptocurrency launching July 2026

- Colliers represents seller in sale of 34,430-square-foot office building in Sugar Land, Texas

- Maui Luxury Real Estate Agents Share Fun Ways to Stay Active on Maui!

- Seven-Year-Old Toronto Dancer Julianna Selivanov Wins Nine Medals at Quebec Championship and Reaches Finals at UK Dance Festival

- PulteGroup expands Northeast Florida presence with Seminole Palms and Lakeview Estates

- JiT Home Buyers Provides Guidance for Families Navigating Inherited Homes Nationwide

- Progressive Dental & The Closing Institute Partner with Zest Dental Solutions to Elevate Full-Arch Growth and Patient Outcomes

- The Real Estate Ecosystem Built for You

- Spring Surge in 55+ Communities: What Buyers and Sellers Need to Know in 2026

- Jason Caras Launches The Caras Institute Following Successful Exit from IT Authorities

- Serina Damesworth Hired as Century Fasteners Corp. – Director of Quality

- JiT Home Buyers Emphasizes Transparency and Clear Communication in Direct Home Sales Nationwide

- National Expansion Ignited Across Amazon $AMZN, Chewy $CHWY & Walmart $WMT: NDT Pharmaceuticals, Inc. (Stock Symbol: NDTP) $NDTP

- Buying Islamorada Luxury Real Estate: What You Need to Know

- Distributed Social Media - Own Your Content