Popular on Rezul

- Still Using Ice? FrostSkin Reinvents Hydration - 131

- Ice Melts. Infrastructure Fails. What Happens to Clean Water?

- Mend Colorado Launches Revamped Sports Performance Training Page

- Cold. Clean. Anywhere. Meet FrostSkin

- Actor, Spokesperson Rio Rocket Featured in "Switch to AT&T" Campaign Showing How Customers Can BYOD and Keep Their Number

- The World's No.1 Superstar® Brings Disco Fever Back With New Global Single and Video "Disco Dancing"

- Boston Industrial Solutions' Natron® 512N Series UV LED Ink Achieves BPA Certification, Advancing Safe and Sustainable Digital Printing

- New Children's Picture Book "Diwa of Mount Luntian" Focuses on Calm, Culture, and Connection for Today's Families

- Work 365 Delivers Purpose-Built Revenue Operations for Microsoft Cloud for US Government

- HBR Colorado Publishes In-Depth Guide on Selling a Home Without an Agent in Denver

Similar on Rezul

- Quadcode Acquires Significant Stake in Game 7, LLC - The Parent Company for FPFX Tech and PropAccount.com

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

- Claude Riveloux Review 2026: How the $10B Fund Manager Dispels 'Scam' Rumors Through Education

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Sellvia Market Expands Curated Store Portfolio for Dropshipping Sellers

IQSTEL Enters 2026 from a Position of Strength Following Transformational Year Marked by N A S D A Q Uplisting, Record Revenue and First-Ever

Rezul News/10723903

IQSTEL, Inc. (N A S D A Q: IQST) $IQST Reports $12.23 in Assets per Share and $4.66 in Equity Per Share! Undervalued by Dollars.

CORAL GABLES, Fla. - Rezul -- IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a differentiated global technology platform following a landmark 2025 that fundamentally reshaped the company's scale, credibility, and growth trajectory. With a successful NASDAQ uplisting, a revenue run rate exceeding $400 million, expanding profitability, entry into AI-driven cybersecurity, and the declaration of its first-ever shareholder dividend, IQST appears positioned for what management describes as an unprecedented 2026.

From Telecom Operator to Diversified Global Technology Platform

Operating across 21 countries, IQST delivers high-value services spanning telecommunications, fintech, artificial intelligence, blockchain, cybersecurity, and electric vehicle solutions. The company has spent years building a trusted commercial platform, selling millions of dollars per month to global customers—particularly telecom operators.

By leveraging those established relationships, IQST is now accelerating the rollout of higher-margin, technology-driven products, transforming the business from a traditional telecom operator into a diversified, scalable digital services provider.

This evolution is central to IQST's long-term roadmap, which targets a $15 million EBITDA run rate in 2026 and a $1 billion revenue run rate by 2027 through organic growth, acquisitions, and expanded high-margin offerings.

Record Revenue Growth and Improving Profitability

IQST's financial performance in 2025 underscores the strength of its platform and execution.

In Q3 2025, the company delivered:

For the nine months ended September 30, 2025, revenue reached $232.6 million, up 26% year-over-year.

More on Rezul News

The balance sheet also strengthened meaningfully, with:

Debt-Free N A S D A Q Company with a Clean Capital Structure

In October, $IQST completed the elimination of all convertible notes and fully paid for its most recent acquisitions, officially becoming a debt-free NASDAQ-listed company with no warrants or convertible securities outstanding.

This clean capital structure is notable in the small-cap technology space and reflects management's stated focus on long-term shareholder value, disciplined execution, and financial transparency.

Fintech Division Gains Momentum with Globetopper

IQST's Fintech division, now representing approximately 20% of total revenue, is playing an increasingly important role in profitability.

The acquisition of Globetopper, completed July 1, 2025, is already contributing meaningfully:

IQST plans to leverage its existing relationships with more than 600 telecom operators worldwide to cross-sell Globetopper's fintech services, unlocking scale efficiencies and margin expansion.

Strategic Expansion into AI and Cybersecurity

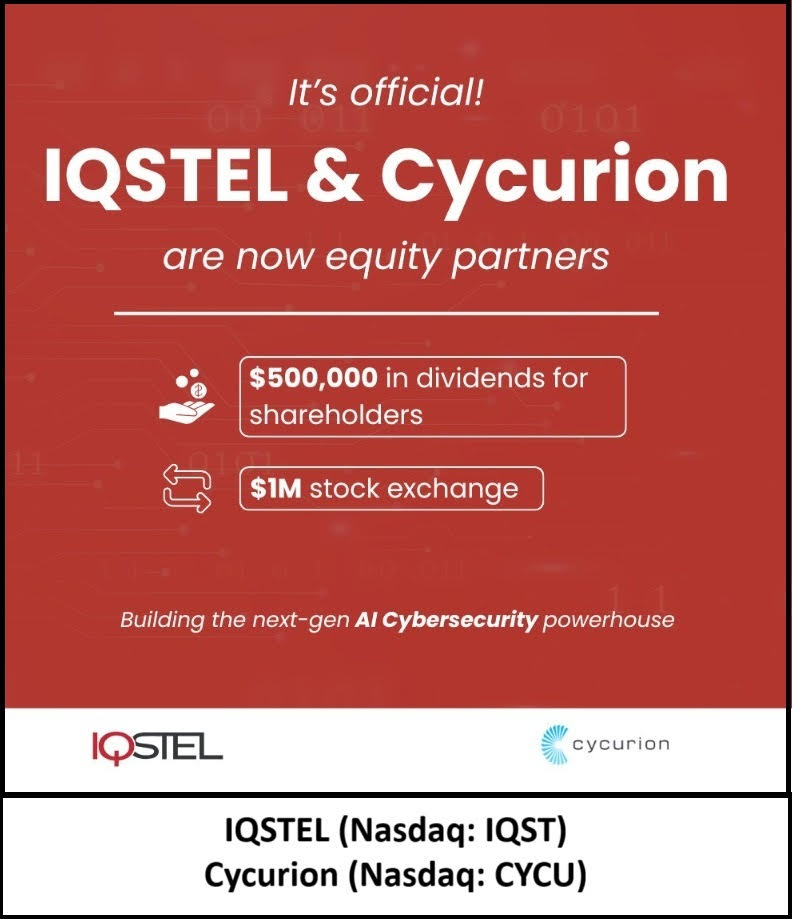

During 2025, IQST formally expanded into AI-enhanced cybersecurity, partnering with Cycurion (N A S D A Q: CYCU). In October, the company completed Phase One of its next-generation cyber defense rollout, integrating its proprietary AI platforms—Airweb.ai and IQ2Call.ai—with Cycurion's ARx multi-layer cybersecurity system.

This milestone positions IQST to deliver secure, AI-powered digital communication and customer engagement solutions to enterprises, telecom operators, and regulated industries.

In parallel, $IQST continues to deploy proprietary AI technologies across its business, including partnerships with U.S.-based healthcare call centers to implement next-generation AI communication systems.

More on Rezul News

First-Ever Dividend Signals Confidence and Maturity

One of the most notable developments of 2025 was IQST's announcement of its first-ever shareholder dividend—a $500,000 distribution payable in free-trading IQST common shares.

The dividend, declared in December and distributed to shareholders of record as of December 15, reflects management's confidence in the company's financial position and long-term strategy. It also signals a shift toward a more mature capital allocation approach while maintaining aggressive growth objectives.

Growing Institutional Visibility

Following the N A S D A Q uplisting, IQST has expanded its institutional outreach:

These developments are increasing IQST's visibility among long-term investors as it transitions into its next growth phase.

Looking Ahead: Execution and Scale in 2026

With foundational milestones achieved, IQST enters 2026 focused on execution:

Following a year defined by transformation, IQST now appears positioned to capitalize on its expanded platform, strengthened balance sheet, and diversified revenue streams—setting the stage for what could be its most consequential growth phase yet.

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

Company Contact:

IQSTEL, Inc. (N A S D A Q: IQST)

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

From Telecom Operator to Diversified Global Technology Platform

Operating across 21 countries, IQST delivers high-value services spanning telecommunications, fintech, artificial intelligence, blockchain, cybersecurity, and electric vehicle solutions. The company has spent years building a trusted commercial platform, selling millions of dollars per month to global customers—particularly telecom operators.

By leveraging those established relationships, IQST is now accelerating the rollout of higher-margin, technology-driven products, transforming the business from a traditional telecom operator into a diversified, scalable digital services provider.

This evolution is central to IQST's long-term roadmap, which targets a $15 million EBITDA run rate in 2026 and a $1 billion revenue run rate by 2027 through organic growth, acquisitions, and expanded high-margin offerings.

Record Revenue Growth and Improving Profitability

IQST's financial performance in 2025 underscores the strength of its platform and execution.

In Q3 2025, the company delivered:

- Record quarterly revenue of $102.8 million, representing 42% sequential growth and 90% year-over-year growth

- A revenue run rate of $411.5 million

- Adjusted EBITDA of $683,189 for the quarter

- Adjusted EBITDA run rate of $2.73 million

For the nine months ended September 30, 2025, revenue reached $232.6 million, up 26% year-over-year.

More on Rezul News

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

The balance sheet also strengthened meaningfully, with:

- $46.8 million in total assets ($12.23 per share)

- $17.8 million in stockholders' equity ($4.66 per share), reflecting a 50% increase from year-end 2024

Debt-Free N A S D A Q Company with a Clean Capital Structure

In October, $IQST completed the elimination of all convertible notes and fully paid for its most recent acquisitions, officially becoming a debt-free NASDAQ-listed company with no warrants or convertible securities outstanding.

This clean capital structure is notable in the small-cap technology space and reflects management's stated focus on long-term shareholder value, disciplined execution, and financial transparency.

Fintech Division Gains Momentum with Globetopper

IQST's Fintech division, now representing approximately 20% of total revenue, is playing an increasingly important role in profitability.

The acquisition of Globetopper, completed July 1, 2025, is already contributing meaningfully:

- Approximately $16 million in Q3 2025 revenue

- Positive EBITDA contribution in its first full quarter

IQST plans to leverage its existing relationships with more than 600 telecom operators worldwide to cross-sell Globetopper's fintech services, unlocking scale efficiencies and margin expansion.

Strategic Expansion into AI and Cybersecurity

During 2025, IQST formally expanded into AI-enhanced cybersecurity, partnering with Cycurion (N A S D A Q: CYCU). In October, the company completed Phase One of its next-generation cyber defense rollout, integrating its proprietary AI platforms—Airweb.ai and IQ2Call.ai—with Cycurion's ARx multi-layer cybersecurity system.

This milestone positions IQST to deliver secure, AI-powered digital communication and customer engagement solutions to enterprises, telecom operators, and regulated industries.

In parallel, $IQST continues to deploy proprietary AI technologies across its business, including partnerships with U.S.-based healthcare call centers to implement next-generation AI communication systems.

More on Rezul News

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- JiT Home Buyers Explains the 70% Rule Investors Use When Evaluating Residential Properties

First-Ever Dividend Signals Confidence and Maturity

One of the most notable developments of 2025 was IQST's announcement of its first-ever shareholder dividend—a $500,000 distribution payable in free-trading IQST common shares.

The dividend, declared in December and distributed to shareholders of record as of December 15, reflects management's confidence in the company's financial position and long-term strategy. It also signals a shift toward a more mature capital allocation approach while maintaining aggressive growth objectives.

Growing Institutional Visibility

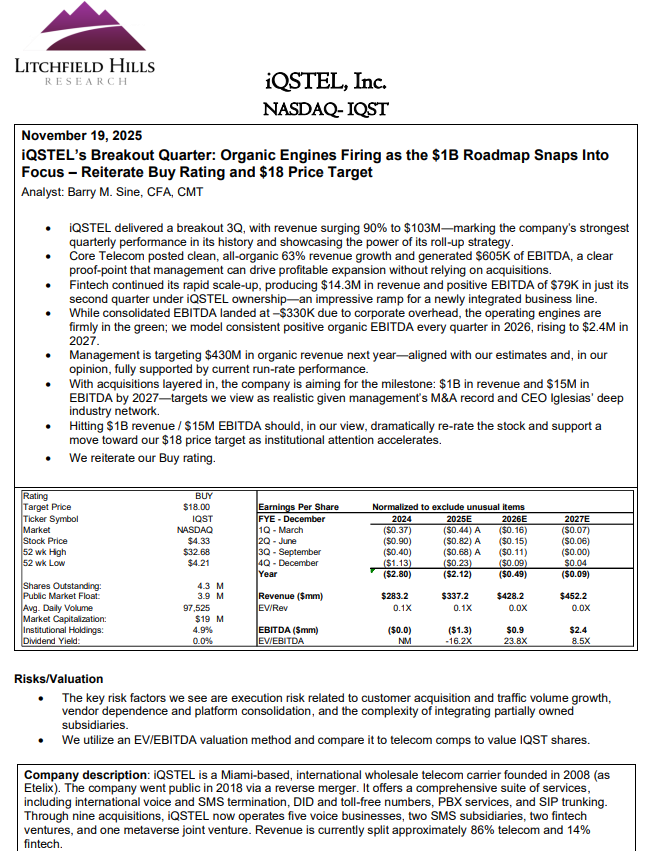

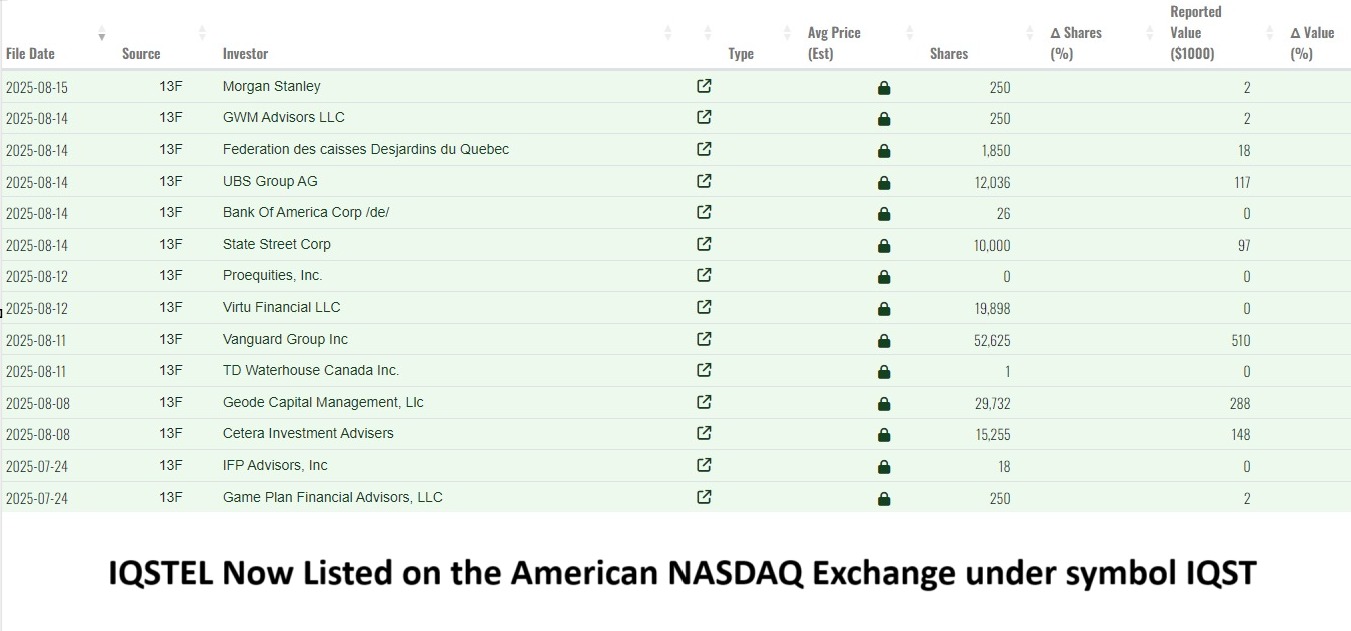

Following the N A S D A Q uplisting, IQST has expanded its institutional outreach:

- 20+ institutional investors now hold approximately 5% of outstanding shares

- Management initiated a webinar roadshow targeting institutions and family offices

- Independent research coverage was initiated by Litchfield Hills Research, which issued a report with an $18 price target

These developments are increasing IQST's visibility among long-term investors as it transitions into its next growth phase.

Looking Ahead: Execution and Scale in 2026

With foundational milestones achieved, IQST enters 2026 focused on execution:

- Scaling high-margin fintech, AI, and cybersecurity services

- Advancing toward a $15 million EBITDA run rate

- Continuing progress toward a $1 billion revenue objective by 2027

Following a year defined by transformation, IQST now appears positioned to capitalize on its expanded platform, strengthened balance sheet, and diversified revenue streams—setting the stage for what could be its most consequential growth phase yet.

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

Company Contact:

IQSTEL, Inc. (N A S D A Q: IQST)

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on Rezul News

- Dr. Sheel Desai Solomon and Preston Dermatology Continue Awards Streak with Top Honors in 2026 Maggy Awards

- JiT Home Buyers Discusses Growing Challenges of Vacant Homes Across U.S. Housing Markets

- Jack and Sage Acquires Sustainable Apparel Brand Kastlfel, Expanding Premium Logo Wear Across National Parks and Ski Resorts

- Green Roofing Options Growing in Popularity Across Oklahoma

- Turnleaf opens seven new decorated model homes

- Alpine Building Performance Launches First Free AI Inspection Forecaster for Real Estate Agents

- Greater Houston Houses LLC Celebrates 20 Years of Helping Houston Homeowners Sell Fast

- Vicinity Disrupts the Lead-Gen Status Quo:Launches Subscription-Based "Ecosystem" with Zero Referral

- Drew Davis Joins Berkshire Hathaway HomeServices Hilton Head Bluffton Realty

- Cancun International Airport Prepares for Record Travel Surge Ahead of Spring Break, Summer, and the 2026 High Season

- $167 Billion Pharma R&D Market Largely Untapped by AI Creates Major Growth Runway for KALA Bios Data-Sovereign AI Strategy: N A S D A Q: KALA

- Lighthouse Tech Awards Recognize Top HR Technology Providers for 2026

- ADB Selects OneVizion to Advance Field Execution and Infrastructure Program Management

- Memelinked Social Media powered by cryptocurrency launching July 2026

- Colliers represents seller in sale of 34,430-square-foot office building in Sugar Land, Texas

- Maui Luxury Real Estate Agents Share Fun Ways to Stay Active on Maui!

- Seven-Year-Old Toronto Dancer Julianna Selivanov Wins Nine Medals at Quebec Championship and Reaches Finals at UK Dance Festival

- PulteGroup expands Northeast Florida presence with Seminole Palms and Lakeview Estates

- JiT Home Buyers Provides Guidance for Families Navigating Inherited Homes Nationwide

- Progressive Dental & The Closing Institute Partner with Zest Dental Solutions to Elevate Full-Arch Growth and Patient Outcomes