Popular on Rezul

- Tatanka Run Announces Phase-2 Development Following Completion of Phase-1 Spec Home

- Inside the Fight for Affordable Housing: Avery Headley Joins Terran Lamp for a Candid Bronx Leadership Conversation

- Controversial Vegan Turns Rapper Launches First Song, "Psychopathic Tendencies."

- Data Over Drama: Market Trends 2026 to discuss what's next for Florida's real estate market

- Zacuto Group Brokers Sale of 1936 Mateo Street in Downtown Los Angeles

- Beucher Insurance Agency Responds to Historic Rain Event in North Lake County Florida

- Laurie McLennan and The McLennan Team Announces Strong Finish to 2025 With Notable Luxury Sales in La Quinta and Palm Desert

- UK Financial Ltd Announces A Special Board Meeting Today At 4PM: Orders MCAT Lock on CATEX, Adopts ERC-3643 Standard, & Cancels $0.20 MCOIN for $1

- From Cheer to Courtroom: The Hidden Legal Risks in Your Holiday Eggnog

- T-TECH Partners with Japan USA Precision Tools for 2026 US Market Development of the New T-TECH 5-Axis QUICK MILL™

Similar on Rezul

- eJoule Inc Participates in Silicon Dragon CES 2026

- HBZBZL Unveils "Intelligent Ecosystem" Strategy: Integrating AI Analytics with Web3 Incubation

- Kaltra Launches Next-Gen MCHEdesign With Full Integration Into MCHEselect — Instant Simulation & Seamless Microchannel Coil Workflow

- Trump's Executive Order Rescheduling Cannabis: Accelerating M&A in a Multibillion-Dollar Industry

- Nextvisit Co-Founder Ryan Yannelli Identifies Six Critical Factors for Behavioral Health Providers Evaluating AI Scribes in 2026

- CredHub and Real Property Management Join Forces to Empower Franchise Owners with Rental Payment Credit Reporting Solutions

- Russellville Huntington Learning Center Expands Access to Literacy Support; Approved Provider Under Arkansas Department of Education

- UK Financial Ltd Launches U.S. Operations Following Delaware Approval

- Pinealage: the app that turns strangers into meditation companions — in crowdfunding phase

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026

$500,000 in Stock Dividend for Shareholders in 2025 Sweetens The Pot on Success of Becoming Debt Free with No Convertible Notes or Warrants for $IQST

Rezul News/10717610

IQSTEL, Inc. (N A S D A Q: IQST) $IQST Featured in Litchfield Hills Research Report with $18 price target on high-margin growth strategy

CORAL GABLES, Fla. - Rezul -- IQST Delivers Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

Partnership with Call Center in U.S. Health Services to Implement Next-Generation AI Solutions Using IQST Proprietary AI Technology.

2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution.

IQST and CYCU Execute $1 Million Stock Exchange, Announce Dividend Distribution and Strategic AI Cybersecurity Alliance.

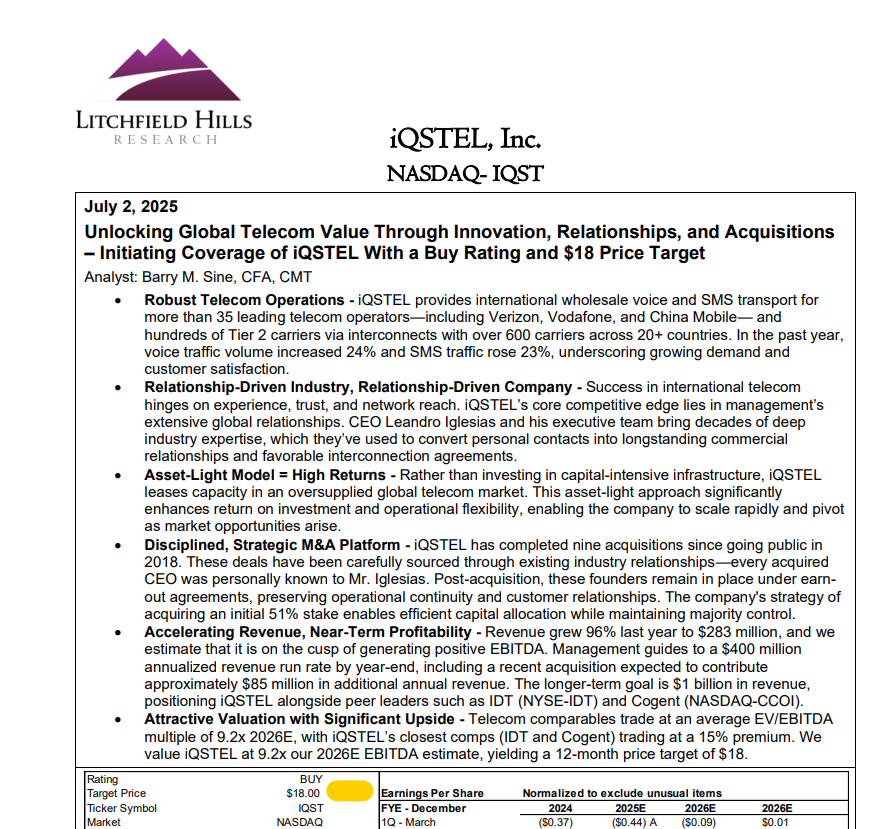

Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year.

Q2 Results: $17.41 Assets Per Share, Beating Metrics Including Net Shareholders' Equity, Gross Revenue, Gross Margin, Net Income, and Adjusted EBITDA

Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share.

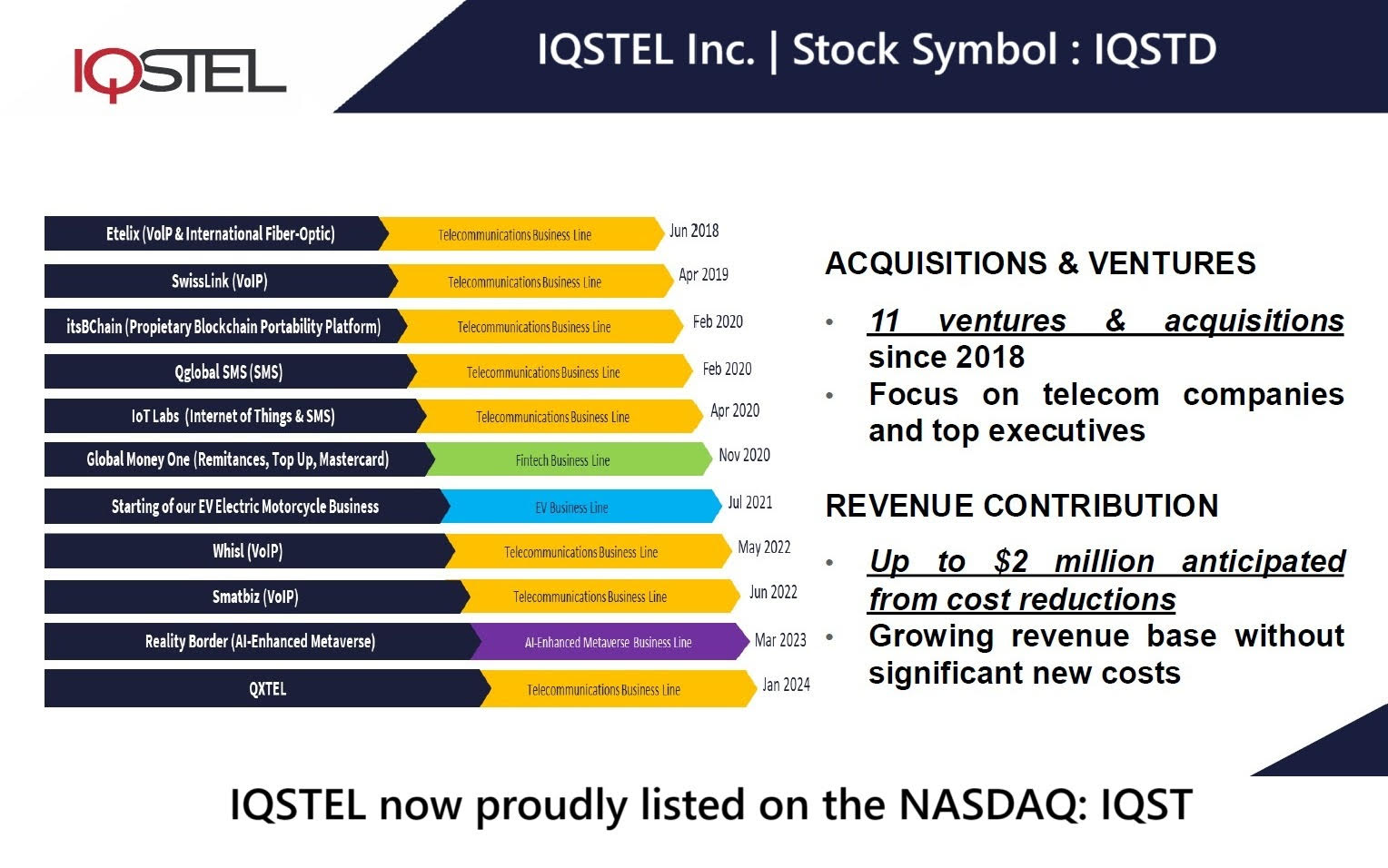

IQSTEL, Inc. (N A S D A Q: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution

On September 16th IQST announced that its Fintech Division is positioned to play a key role in achieving the Company's goal of reaching a $15 million EBITDA run rate in 2026.

IQST completed the acquisition of Globetopper on July 1, 2025, and has since been accelerating its growth as part of the Company's strategic roadmap. Globetopper is expected to contribute approximately $16 million in Q3 2025 revenue and deliver $110,000 in EBITDA, making it cash flow positive for the quarter.

More on Rezul News

IQST plans to leverage its business platform — which already reaches over 600 of the largest telecom operators worldwide — to offer Globetopper's fintech services directly to its telecom customers. This initiative is part of the IQST strategy to cross-sell high-margin, high-tech services to its existing client base, maximizing the value of its global relationships and accelerating revenue and EBITDA growth.

IQST Becomes a Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year

On October 9th IQST announced it has eliminated all convertible notes from its balance sheet and fully paid for its most recent acquisitions, QXTEL and Globetopper.

With this achievement, IQST has officially become a debt-free company — with no convertible notes and no warrants outstanding — reinforcing its solid financial foundation and long-term commitment to creating shareholder value. IQST stands out with $17.41 in assets per share and a clean capital structure with zero convertible debt and no warrants outstanding.

In conjunction with this financial progress, IQST plans to distribute a $500,000 dividend in shares before the end of 2025, as part of its strategic partnership with Cycurion (CYCU).

Through this partnership, IQST has entered the cybersecurity arena with a trusted U.S. government-certified technology provider, expanding its portfolio of Telecom, Fintech, AI, and Digital services.

To enhance transparency and provide easy access to corporate updates, IQST has launched its official Investors Landing Page, a dedicated portal summarizing key financial metrics, strategic milestones, and news updates. Visit: www.landingpage.iqstel.com

IQST Celebrates 120 Days on N A S D A Q with Institutional Investors, Analyst Coverage, and Cycurion Dividend Driving AI & Digital Expansion

On September 24th IQST announced the release of its 120-Day Nasdaq Shareholder Letter, highlighting the Company's performance, growth trajectory, and increasing institutional recognition since uplisting to N A S D A Q. The letter included these key IQST highlights:

Diversified Growth – Four strategic business lines: Telecommunications, Fintech, Artificial Intelligence, and Cybersecurity.

Global Reach – Operations in 20+ countries, with commercial relationships spanning 600+ of the world's largest telecom operators.

More on Rezul News

High-Margin Expansion – A powerful platform to layer in additional services, including AI, fintech, and cybersecurity solutions — highlighted by our partnership with Cycurion (CYCU).

Intelligence Momentum – The IQST Intelligence division is growing faster than expected. Highlights include the ONAR partnership, the Mobility Tech partnership, the Cycurion alliance, plus three more contracts in the sales funnel, expected to close before year-end.

Strong Financial Trajectory – On track toward $1 billion in revenue by 2027, with a projected $15M EBITDA run rate in 2026.

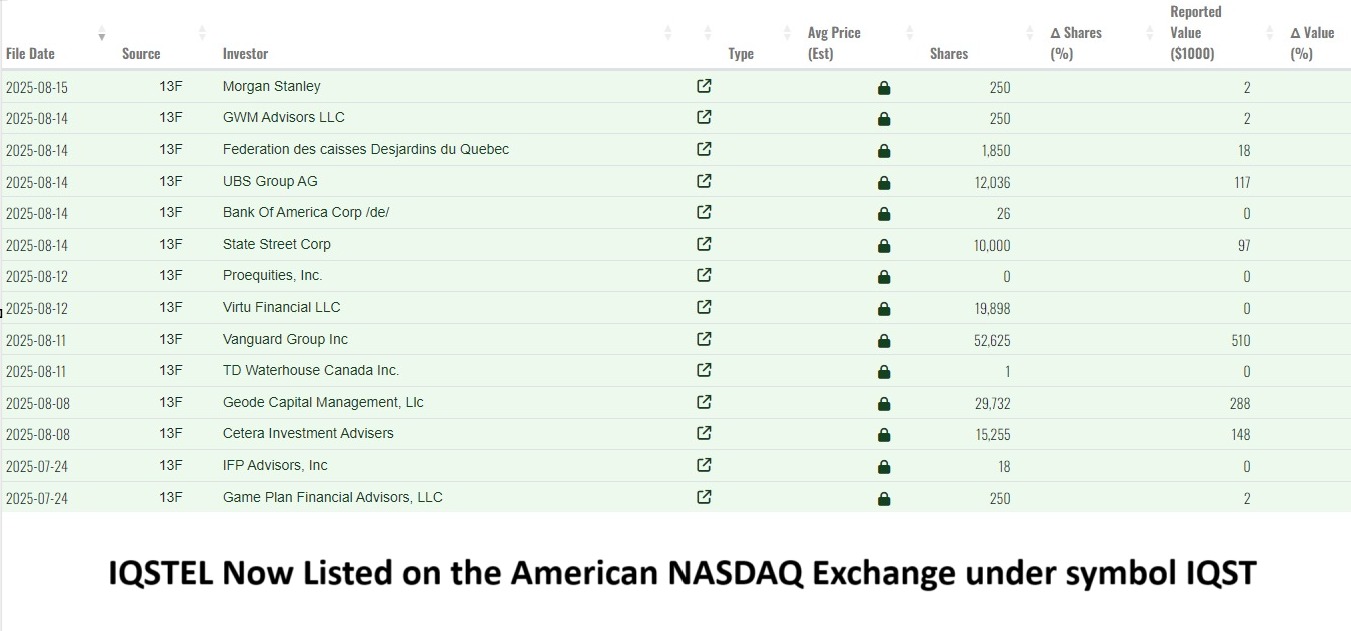

Institutional Confidence – Approximately 12 institutional investors now hold 4% of IQST shares, just 120 days after our Nasdaq uplisting.

Research Recognition – Litchfield Hills Research issued a detailed report with an $18 price target: https://shre.ink/te9s

Momentum in Q2 & Q3 – $35M revenue in July, surpassing a $400M annual run rate five months ahead of schedule. Assets per share stand at $17.41, outperforming across net equity, gross revenue, margins, net income, and adjusted EBITDA.

Strategic Alliances – IQST and CYCU executed a $1M stock exchange and dividend distribution, with IQST planning to distribute $500,000 in CYCU N A S D A Q shares to its shareholders as part of the partnership.

Innovation in AI – Launch of www.IQ2Call.ai, targeting the $750B global market with vertical AI-Telecom integration, including next-gen AI for U.S. healthcare call centers.

Fintech Acceleration – Acquisition of Globetopper (July 1, 2025), forecasted to add $34M revenue and positive EBITDA in H2 2025.

Balance Sheet Strength – $6.9M debt reduction (~$2 per share), reinforcing our equity position. Notably, half of this debt was voluntarily converted by investors into Preferred Shares, underscoring their trust in IQSTEL's vision, management, and growth strategy.

Revenue Mix – Current revenue stream: 80% telecommunications, 20% fintech, with fintech and AI & Digital services set to accelerate growth.

Watch CEO Leandro Iglesias share his vision for IQST growth: https://acortar.link/st2ZLb

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

IQST Media Contact:

Company: IQSTEL, Inc. (N A S D A Q: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Partnership with Call Center in U.S. Health Services to Implement Next-Generation AI Solutions Using IQST Proprietary AI Technology.

2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution.

IQST and CYCU Execute $1 Million Stock Exchange, Announce Dividend Distribution and Strategic AI Cybersecurity Alliance.

Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year.

Q2 Results: $17.41 Assets Per Share, Beating Metrics Including Net Shareholders' Equity, Gross Revenue, Gross Margin, Net Income, and Adjusted EBITDA

Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share.

IQSTEL, Inc. (N A S D A Q: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution

On September 16th IQST announced that its Fintech Division is positioned to play a key role in achieving the Company's goal of reaching a $15 million EBITDA run rate in 2026.

IQST completed the acquisition of Globetopper on July 1, 2025, and has since been accelerating its growth as part of the Company's strategic roadmap. Globetopper is expected to contribute approximately $16 million in Q3 2025 revenue and deliver $110,000 in EBITDA, making it cash flow positive for the quarter.

More on Rezul News

- Comanche Christmas Parade Wraps the Town in Holiday Cheer

- Guests Can Save 25 Percent Off Last Minute Bookings at KeysCaribbean's Village at Hawks Cay Villas

- Trump's Executive Order Rescheduling Cannabis: Accelerating M&A in a Multibillion-Dollar Industry

- Genuine Hospitality, LLC Selected to Operate Hilton Garden Inn Birmingham SE / Liberty Park

- American Net Lease Facilitates Sale of Dollar General in Conroe, Texas

IQST plans to leverage its business platform — which already reaches over 600 of the largest telecom operators worldwide — to offer Globetopper's fintech services directly to its telecom customers. This initiative is part of the IQST strategy to cross-sell high-margin, high-tech services to its existing client base, maximizing the value of its global relationships and accelerating revenue and EBITDA growth.

IQST Becomes a Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year

On October 9th IQST announced it has eliminated all convertible notes from its balance sheet and fully paid for its most recent acquisitions, QXTEL and Globetopper.

With this achievement, IQST has officially become a debt-free company — with no convertible notes and no warrants outstanding — reinforcing its solid financial foundation and long-term commitment to creating shareholder value. IQST stands out with $17.41 in assets per share and a clean capital structure with zero convertible debt and no warrants outstanding.

In conjunction with this financial progress, IQST plans to distribute a $500,000 dividend in shares before the end of 2025, as part of its strategic partnership with Cycurion (CYCU).

Through this partnership, IQST has entered the cybersecurity arena with a trusted U.S. government-certified technology provider, expanding its portfolio of Telecom, Fintech, AI, and Digital services.

To enhance transparency and provide easy access to corporate updates, IQST has launched its official Investors Landing Page, a dedicated portal summarizing key financial metrics, strategic milestones, and news updates. Visit: www.landingpage.iqstel.com

IQST Celebrates 120 Days on N A S D A Q with Institutional Investors, Analyst Coverage, and Cycurion Dividend Driving AI & Digital Expansion

On September 24th IQST announced the release of its 120-Day Nasdaq Shareholder Letter, highlighting the Company's performance, growth trajectory, and increasing institutional recognition since uplisting to N A S D A Q. The letter included these key IQST highlights:

Diversified Growth – Four strategic business lines: Telecommunications, Fintech, Artificial Intelligence, and Cybersecurity.

Global Reach – Operations in 20+ countries, with commercial relationships spanning 600+ of the world's largest telecom operators.

More on Rezul News

- American Net Lease Facilitates Acquisition of Bojangles in Hartsville, SC

- Documentary "Prescription for Violence: Psychiatry's Deadly Side Effects" Premieres, Exposes Link Between Psychiatric Drugs and Acts of Mass Violence

- A Symphony of Support: Trang & David Hooser Champion Arts Education for Autistic Youth at NSA's Annual Gala

- Price Improvement on Luxurious Lāna'i Townhome with Stunning Ocean Views

- Comanche Methodist Church Serves 500 Meals, Strengthening Community Connections

High-Margin Expansion – A powerful platform to layer in additional services, including AI, fintech, and cybersecurity solutions — highlighted by our partnership with Cycurion (CYCU).

Intelligence Momentum – The IQST Intelligence division is growing faster than expected. Highlights include the ONAR partnership, the Mobility Tech partnership, the Cycurion alliance, plus three more contracts in the sales funnel, expected to close before year-end.

Strong Financial Trajectory – On track toward $1 billion in revenue by 2027, with a projected $15M EBITDA run rate in 2026.

Institutional Confidence – Approximately 12 institutional investors now hold 4% of IQST shares, just 120 days after our Nasdaq uplisting.

Research Recognition – Litchfield Hills Research issued a detailed report with an $18 price target: https://shre.ink/te9s

Momentum in Q2 & Q3 – $35M revenue in July, surpassing a $400M annual run rate five months ahead of schedule. Assets per share stand at $17.41, outperforming across net equity, gross revenue, margins, net income, and adjusted EBITDA.

Strategic Alliances – IQST and CYCU executed a $1M stock exchange and dividend distribution, with IQST planning to distribute $500,000 in CYCU N A S D A Q shares to its shareholders as part of the partnership.

Innovation in AI – Launch of www.IQ2Call.ai, targeting the $750B global market with vertical AI-Telecom integration, including next-gen AI for U.S. healthcare call centers.

Fintech Acceleration – Acquisition of Globetopper (July 1, 2025), forecasted to add $34M revenue and positive EBITDA in H2 2025.

Balance Sheet Strength – $6.9M debt reduction (~$2 per share), reinforcing our equity position. Notably, half of this debt was voluntarily converted by investors into Preferred Shares, underscoring their trust in IQSTEL's vision, management, and growth strategy.

Revenue Mix – Current revenue stream: 80% telecommunications, 20% fintech, with fintech and AI & Digital services set to accelerate growth.

Watch CEO Leandro Iglesias share his vision for IQST growth: https://acortar.link/st2ZLb

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

IQST Media Contact:

Company: IQSTEL, Inc. (N A S D A Q: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on Rezul News

- RealEstateRelated.com Expands AI Platform Following Pre-Seed Equity Round

- New Active Adult Ranch Homes by O'Dwyer Now Selling at Highly Anticipated Lake Society on Lake

- O'Dwyer Homes Introduces Bridgeview, New Semi-Custom Homes near Downtown Canton

- Pinealage: the app that turns strangers into meditation companions — in crowdfunding phase

- OKC Roofer Releases "Ultimate End-of-Year Roof Checklist" to Help Homeowners Prepare for Winter

- "Micro-Studio": Why San Diegans are Swapping Crowded Gyms for Private, One-on-One Training at Sweat Society

- Beycome Closes $2.5M Seed Round Led by InsurTech Fund

- Tatanka Run Announces Phase-2 Development Following Completion of Phase-1 Spec Home

- Tru by Hilton Columbia South Opens to Guests

- Christy Sports donates $56K in new gear to SOS Outreach to help kids hit the slopes

- PulteGroup Northeast Florida's 4th Annual Building Hope Golf Tournament raises record $224,331

- Newest David Weekley Homes Community Now Open In Georgia's Forsyth County

- "BigPirate" Sets Sail: A New Narrative-Driven Social Casino Adventure

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026

- Women's Everyday Safety Is Changing - The Blue Luna Shows How

- Microgaming Unveils Red Papaya: A New Studio Delivering Cutting-Edge, Feature-Rich Slots

- Why Buying a Home at Christmas will be Your Best Christmas Ever

- Adam's Plumbing & Heating Unveils the Ultimate Lakewood Plumbing Repair & Installation Resource for Homeowners and Businesses

- Hendricks Property Management #1 Property Manager in San Antonio & #27 Nationwide | Proudly Local

- 5-Star Duncan Injury Group Expands Personal Injury Representation to Arizona