Popular on Rezul

- Still Using Ice? FrostSkin Reinvents Hydration - 131

- Ice Melts. Infrastructure Fails. What Happens to Clean Water?

- Mend Colorado Launches Revamped Sports Performance Training Page

- Cold. Clean. Anywhere. Meet FrostSkin

- Actor, Spokesperson Rio Rocket Featured in "Switch to AT&T" Campaign Showing How Customers Can BYOD and Keep Their Number

- The World's No.1 Superstar® Brings Disco Fever Back With New Global Single and Video "Disco Dancing"

- Boston Industrial Solutions' Natron® 512N Series UV LED Ink Achieves BPA Certification, Advancing Safe and Sustainable Digital Printing

- Work 365 Delivers Purpose-Built Revenue Operations for Microsoft Cloud for US Government

- New Children's Picture Book "Diwa of Mount Luntian" Focuses on Calm, Culture, and Connection for Today's Families

- HBR Colorado Publishes In-Depth Guide on Selling a Home Without an Agent in Denver

Similar on Rezul

- Quadcode Acquires Significant Stake in Game 7, LLC - The Parent Company for FPFX Tech and PropAccount.com

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

- Claude Riveloux Review 2026: How the $10B Fund Manager Dispels 'Scam' Rumors Through Education

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Sellvia Market Expands Curated Store Portfolio for Dropshipping Sellers

$430 Million 2026 Revenue Forecast; 26% Organic Growth; $500,000 Stock Dividend Highlight a Powerful AI & Digital Transformation Story: IQSTEL $IQST

Rezul News/10719187

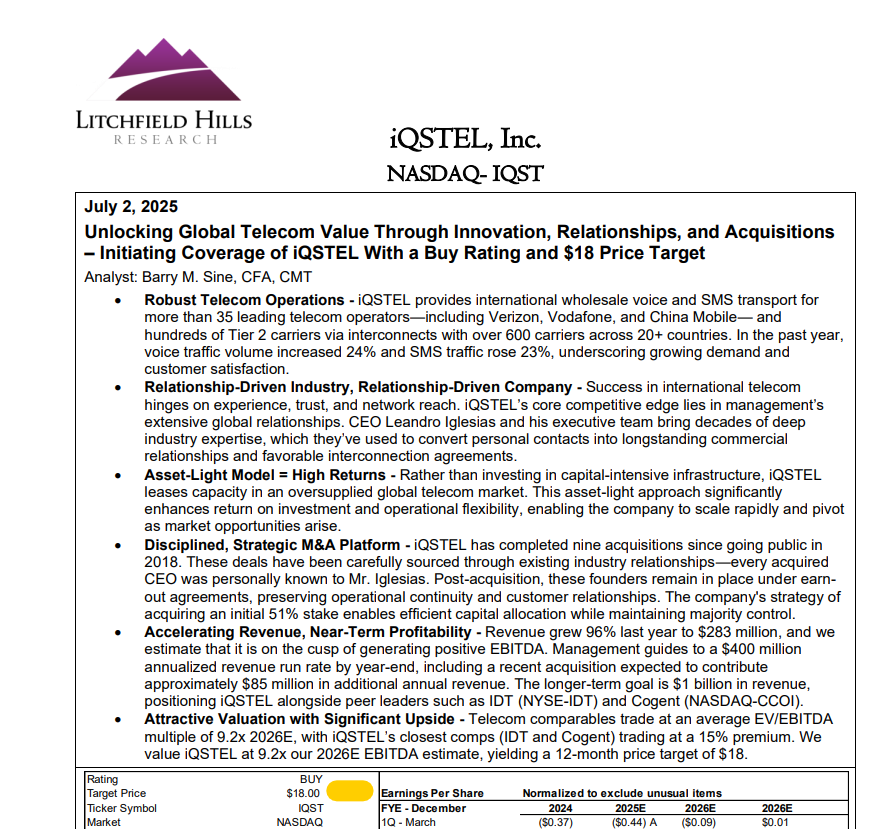

IQSTEL, Inc. (N A S D A Q: IQST) $IQST is Featured in Litchfield Hills Research Report with $18 price target on high-margin growth strategy

CORAL GABLES, Fla. - Rezul -- IQSTEL, Inc. (N A S D A Q: IQST) $IQST — a global technology leader operating at the intersection of Telecommunications, Fintech, Artificial Intelligence (AI), and Cybersecurity — is capturing investor attention with bold growth forecasts, a solid balance sheet, and expanding institutional support.

With a projected $430 million in 2026 organic revenue (up 26% year-over-year), and a $500,000 stock dividend planned for shareholders by year-end 2025, IQSTEL is positioning itself as one of the most diversified and fastest-growing AI-integrated digital communications companies on Nasdaq.

AI, Fintech, and Telecom Synergy Powering the Next Phase of Growth

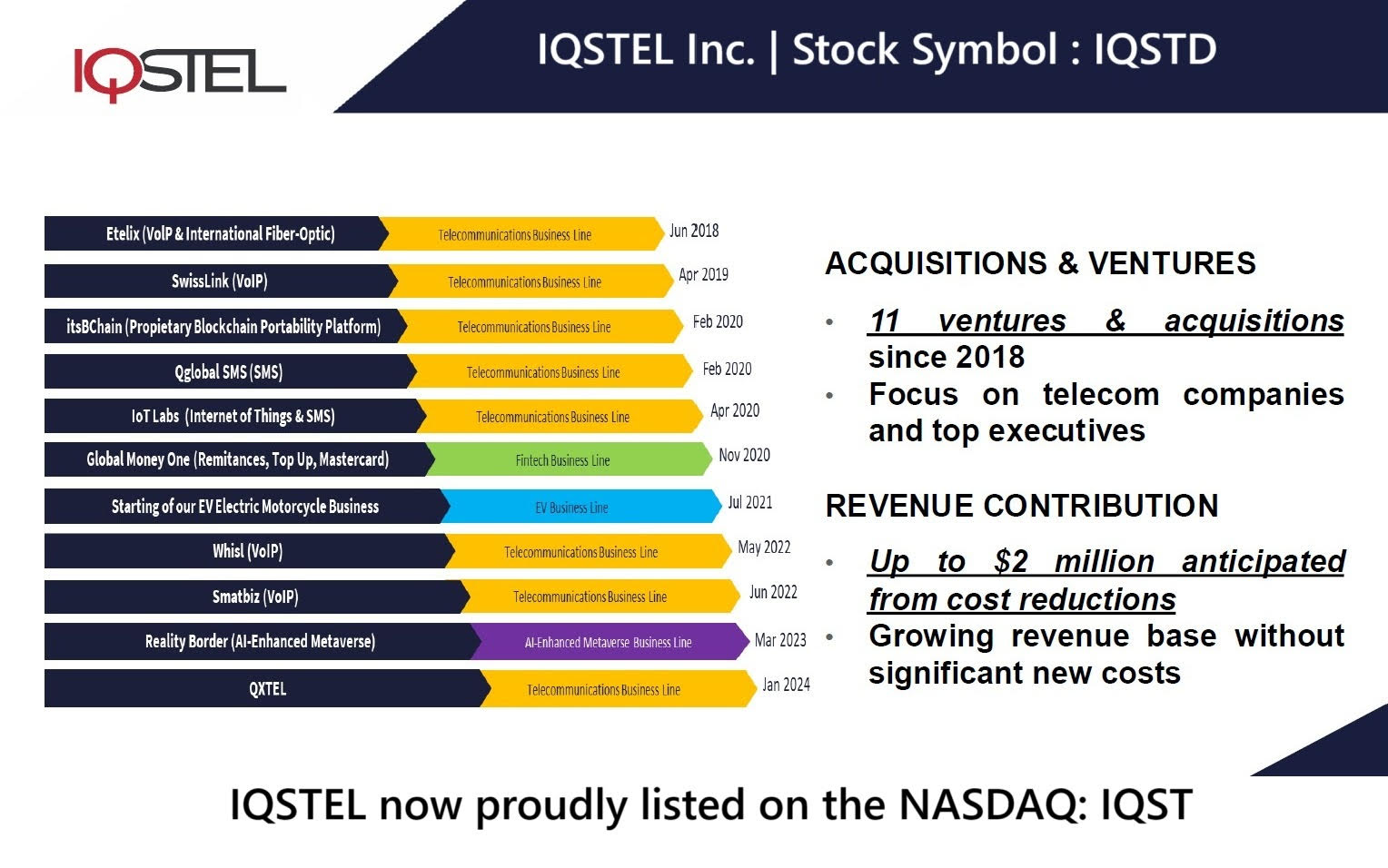

IQSTEL operates in 21 countries and serves a global base of telecom and enterprise clients. The company's four synergistic divisions — Telecom, Fintech, Artificial Intelligence, and Cybersecurity — create a vertically integrated ecosystem designed for high-margin, scalable growth.

IQSTEL's 2026 revenue forecast of $430 million builds on its 2025 target of $340 million, following $283 million in revenue for FY 2024. The company's track record of meeting or exceeding its forecasts reflects disciplined execution and strong demand across its business lines.

A recent Litchfield Hills Research report reaffirmed this momentum with an $18 price target, citing IQSTEL's "high-margin growth strategy, strong management discipline, and AI-driven product expansion" as key drivers of long-term shareholder value.

"IQSTEL's diversified business model, expanding global footprint, and AI integration strategy give it a unique edge in multiple trillion-dollar markets," said Leandro Jose Iglesias, President and CEO. "Our roadmap to $1 billion in revenue by 2027 is well within reach."

Debt-Free Nasdaq Company With a Clean Capital Structure

On October 9, 2025, IQSTEL achieved a milestone few small-cap Nasdaq companies can claim — becoming a fully debt-free company with no convertible notes or warrants outstanding.

The company also strengthened its equity position with a $6.9 million debt reduction, equivalent to almost $2 per share, reinforcing shareholder value and balance sheet flexibility.

With $17.41 in assets per share, IQSTEL now stands out as a high-transparency, debt-free Nasdaq issuer — a rare combination that has begun attracting increased institutional investment interest.

More on Rezul News

Shareholder Value Expansion: $500,000 Stock Dividend and CYCU Strategic Alliance

In conjunction with its financial transformation, IQSTEL announced plans to distribute a $500,000 stock dividend in 2025 as part of its strategic AI-cybersecurity partnership with Cycurion, Inc. (N A S D A Q: CYCU).

This partnership includes a $1 million stock exchange agreement and joint development of AI-enhanced cybersecurity solutions. Together, IQSTEL's Reality Border AI division and CYCU's ARx platform have completed Phase One of a next-generation cyber defense rollout — integrating secure AI agents with built-in threat prevention and proactive security.

This alliance not only expands IQSTEL's footprint in the AI and cybersecurity markets but also represents a tangible return of value to shareholders through the planned stock dividend.

Fintech Acceleration Through Globetopper Acquisition

IQSTEL's Fintech division continues to be a major EBITDA growth engine. Following the July 1, 2025 acquisition of Globetopper, the division delivered $16 million in Q3 2025 revenue and $110,000 in EBITDA, achieving cash-flow-positive performance in its first full quarter under IQSTEL's management.

Leveraging a global telecom network of over 600 Tier-1 operators, IQSTEL is now cross-selling Globetopper's fintech services to its existing clients — a strategy expected to drive substantial high-margin revenue growth in 2026 and 2027.

Strategic Forecast: $15 Million EBITDA in 2026 and $1 Billion Revenue by 2027

IQSTEL's management has set a clear and credible financial roadmap:

Innovation Spotlight: AI-Telecom Integration for the $750 Billion Global Market

IQSTEL recently launched IQ2Call.ai, a next-generation AI-telecom integration platform designed to revolutionize customer engagement and automation in the $750 billion global telecommunications market.

Litchfield Hills Research Coverage: $18 Price Target and "High Margin Growth" Thesis

In October 2025, Litchfield Hills Research issued a comprehensive report on IQSTEL, assigning an $18 price target and highlighting the company's diversified revenue streams, disciplined cost structure, and clean balance sheet as key strengths.

More on Rezul News

The report praised IQSTEL's "strategic execution, vertical integration across AI and telecom, and consistent forecast achievement" — positioning the company as an undervalued growth story in the AI and digital infrastructure space.

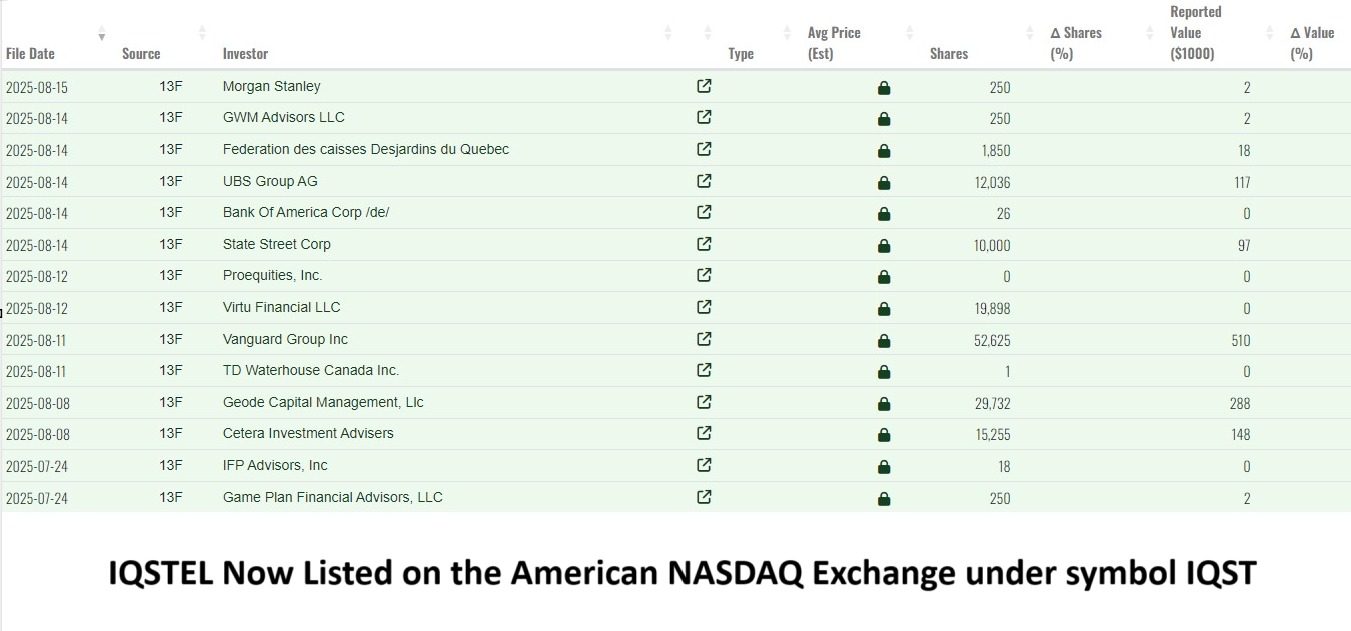

Institutional Confidence and Nasdaq Momentum

Since uplisting to Nasdaq earlier this year, IQSTEL has rapidly gained traction among institutional investors.

In its 120-Day Shareholder Letter (September 24, 2025), the company reported:

A Debt-Free, AI-Driven Growth Story with Global Scale

IQSTEL's combination of diversified revenue, global market reach, and strong financial discipline gives investors a rare opportunity to participate in a multi-sector AI and digital transformation leader.

With no debt, no convertible notes, no warrants, and $17.41 in assets per share, IQSTEL enters 2026 with one of the cleanest capital structures among its peers — and a clear roadmap toward sustainable profitability, shareholder rewards, and billion-dollar revenue potential.

Key Investor Highlights

About IQSTEL, Inc. (N A S D A Q: IQST)

IQSTEL, Inc. is a global AI and digital communications company offering cutting-edge solutions in Telecommunications, Fintech, Blockchain, Artificial Intelligence, and Cybersecurity. With operations in 21 countries, IQSTEL provides high-value, high-margin services to a global customer base spanning over 600 telecom operators and enterprises. The company's mission is to leverage innovation to build a more connected, intelligent, and secure digital world.

Website: www.IQSTEL.com

Investor Page: www.landingpage.iqstel.com

Contact: Leandro Jose Iglesias, President & CEO

Email: investors@iqstel.com

Phone: +1 (954) 951-8191

Country: United States

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a projected $430 million in 2026 organic revenue (up 26% year-over-year), and a $500,000 stock dividend planned for shareholders by year-end 2025, IQSTEL is positioning itself as one of the most diversified and fastest-growing AI-integrated digital communications companies on Nasdaq.

AI, Fintech, and Telecom Synergy Powering the Next Phase of Growth

IQSTEL operates in 21 countries and serves a global base of telecom and enterprise clients. The company's four synergistic divisions — Telecom, Fintech, Artificial Intelligence, and Cybersecurity — create a vertically integrated ecosystem designed for high-margin, scalable growth.

IQSTEL's 2026 revenue forecast of $430 million builds on its 2025 target of $340 million, following $283 million in revenue for FY 2024. The company's track record of meeting or exceeding its forecasts reflects disciplined execution and strong demand across its business lines.

A recent Litchfield Hills Research report reaffirmed this momentum with an $18 price target, citing IQSTEL's "high-margin growth strategy, strong management discipline, and AI-driven product expansion" as key drivers of long-term shareholder value.

"IQSTEL's diversified business model, expanding global footprint, and AI integration strategy give it a unique edge in multiple trillion-dollar markets," said Leandro Jose Iglesias, President and CEO. "Our roadmap to $1 billion in revenue by 2027 is well within reach."

Debt-Free Nasdaq Company With a Clean Capital Structure

On October 9, 2025, IQSTEL achieved a milestone few small-cap Nasdaq companies can claim — becoming a fully debt-free company with no convertible notes or warrants outstanding.

The company also strengthened its equity position with a $6.9 million debt reduction, equivalent to almost $2 per share, reinforcing shareholder value and balance sheet flexibility.

With $17.41 in assets per share, IQSTEL now stands out as a high-transparency, debt-free Nasdaq issuer — a rare combination that has begun attracting increased institutional investment interest.

More on Rezul News

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

Shareholder Value Expansion: $500,000 Stock Dividend and CYCU Strategic Alliance

In conjunction with its financial transformation, IQSTEL announced plans to distribute a $500,000 stock dividend in 2025 as part of its strategic AI-cybersecurity partnership with Cycurion, Inc. (N A S D A Q: CYCU).

This partnership includes a $1 million stock exchange agreement and joint development of AI-enhanced cybersecurity solutions. Together, IQSTEL's Reality Border AI division and CYCU's ARx platform have completed Phase One of a next-generation cyber defense rollout — integrating secure AI agents with built-in threat prevention and proactive security.

This alliance not only expands IQSTEL's footprint in the AI and cybersecurity markets but also represents a tangible return of value to shareholders through the planned stock dividend.

Fintech Acceleration Through Globetopper Acquisition

IQSTEL's Fintech division continues to be a major EBITDA growth engine. Following the July 1, 2025 acquisition of Globetopper, the division delivered $16 million in Q3 2025 revenue and $110,000 in EBITDA, achieving cash-flow-positive performance in its first full quarter under IQSTEL's management.

Leveraging a global telecom network of over 600 Tier-1 operators, IQSTEL is now cross-selling Globetopper's fintech services to its existing clients — a strategy expected to drive substantial high-margin revenue growth in 2026 and 2027.

Strategic Forecast: $15 Million EBITDA in 2026 and $1 Billion Revenue by 2027

IQSTEL's management has set a clear and credible financial roadmap:

- 2025 Revenue Target: $340 million

- 2026 Revenue Forecast: $430 million (26% organic growth)

- 2026 EBITDA Run Rate Goal: $15 million

- 2027 Revenue Goal: $1 billion

Innovation Spotlight: AI-Telecom Integration for the $750 Billion Global Market

IQSTEL recently launched IQ2Call.ai, a next-generation AI-telecom integration platform designed to revolutionize customer engagement and automation in the $750 billion global telecommunications market.

Litchfield Hills Research Coverage: $18 Price Target and "High Margin Growth" Thesis

In October 2025, Litchfield Hills Research issued a comprehensive report on IQSTEL, assigning an $18 price target and highlighting the company's diversified revenue streams, disciplined cost structure, and clean balance sheet as key strengths.

More on Rezul News

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- JiT Home Buyers Explains the 70% Rule Investors Use When Evaluating Residential Properties

The report praised IQSTEL's "strategic execution, vertical integration across AI and telecom, and consistent forecast achievement" — positioning the company as an undervalued growth story in the AI and digital infrastructure space.

Institutional Confidence and Nasdaq Momentum

Since uplisting to Nasdaq earlier this year, IQSTEL has rapidly gained traction among institutional investors.

In its 120-Day Shareholder Letter (September 24, 2025), the company reported:

- 12 institutional investors now hold approximately 4% of IQST shares.

- $35 million July revenue, reflecting a $400 million annualized run rate five months ahead of schedule.

- Continued leadership in telecom and fintech, with AI and cybersecurity now driving accelerated growth.

A Debt-Free, AI-Driven Growth Story with Global Scale

IQSTEL's combination of diversified revenue, global market reach, and strong financial discipline gives investors a rare opportunity to participate in a multi-sector AI and digital transformation leader.

With no debt, no convertible notes, no warrants, and $17.41 in assets per share, IQSTEL enters 2026 with one of the cleanest capital structures among its peers — and a clear roadmap toward sustainable profitability, shareholder rewards, and billion-dollar revenue potential.

Key Investor Highlights

- $430 Million 2026 Organic Revenue Forecast (+26% YoY)

- Debt-Free Nasdaq Company with no convertibles or warrants

- $500,000 Stock Dividend Planned for 2025

- $15 Million EBITDA Run Rate Target for 2026

- $1 Billion Revenue Goal for 2027

- $17.41 Assets per Share, strong balance sheet and equity position

- AI-Cybersecurity Alliance with Cycurion (CYCU)

- Litchfield Hills Research $18 Price Target

- Global Operations in 21 Countries serving 600+ telecom operators

About IQSTEL, Inc. (N A S D A Q: IQST)

IQSTEL, Inc. is a global AI and digital communications company offering cutting-edge solutions in Telecommunications, Fintech, Blockchain, Artificial Intelligence, and Cybersecurity. With operations in 21 countries, IQSTEL provides high-value, high-margin services to a global customer base spanning over 600 telecom operators and enterprises. The company's mission is to leverage innovation to build a more connected, intelligent, and secure digital world.

Website: www.IQSTEL.com

Investor Page: www.landingpage.iqstel.com

Contact: Leandro Jose Iglesias, President & CEO

Email: investors@iqstel.com

Phone: +1 (954) 951-8191

Country: United States

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business

0 Comments

Latest on Rezul News

- Dr. Sheel Desai Solomon and Preston Dermatology Continue Awards Streak with Top Honors in 2026 Maggy Awards

- JiT Home Buyers Discusses Growing Challenges of Vacant Homes Across U.S. Housing Markets

- Jack and Sage Acquires Sustainable Apparel Brand Kastlfel, Expanding Premium Logo Wear Across National Parks and Ski Resorts

- Green Roofing Options Growing in Popularity Across Oklahoma

- Turnleaf opens seven new decorated model homes

- Alpine Building Performance Launches First Free AI Inspection Forecaster for Real Estate Agents

- Greater Houston Houses LLC Celebrates 20 Years of Helping Houston Homeowners Sell Fast

- Vicinity Disrupts the Lead-Gen Status Quo:Launches Subscription-Based "Ecosystem" with Zero Referral

- Drew Davis Joins Berkshire Hathaway HomeServices Hilton Head Bluffton Realty

- Cancun International Airport Prepares for Record Travel Surge Ahead of Spring Break, Summer, and the 2026 High Season

- $167 Billion Pharma R&D Market Largely Untapped by AI Creates Major Growth Runway for KALA Bios Data-Sovereign AI Strategy: N A S D A Q: KALA

- Lighthouse Tech Awards Recognize Top HR Technology Providers for 2026

- ADB Selects OneVizion to Advance Field Execution and Infrastructure Program Management

- Memelinked Social Media powered by cryptocurrency launching July 2026

- Colliers represents seller in sale of 34,430-square-foot office building in Sugar Land, Texas

- Maui Luxury Real Estate Agents Share Fun Ways to Stay Active on Maui!

- Seven-Year-Old Toronto Dancer Julianna Selivanov Wins Nine Medals at Quebec Championship and Reaches Finals at UK Dance Festival

- PulteGroup expands Northeast Florida presence with Seminole Palms and Lakeview Estates

- JiT Home Buyers Provides Guidance for Families Navigating Inherited Homes Nationwide

- Progressive Dental & The Closing Institute Partner with Zest Dental Solutions to Elevate Full-Arch Growth and Patient Outcomes