Popular on Rezul

- Still Using Ice? FrostSkin Reinvents Hydration

- Denver Apartment Finders Launches Revamped Denver Tech Center Apartment Location Page

- Handy Homes Brings Membership-Based Home Maintenance to Short Hills, Maplewood, and Mil

- Roblox and Solsten Alliances; a Stronger Balance Sheet and Accelerated Growth Through AI, Gaming, and Strategic Partnerships for Super League: $SLE

- UK Financial Ltd Lists MayaFund (MFUND) ERC-20 Token on CATEX Exchange Ahead of Planned ERC-3643 Upgrade

- Volarex Named Chartered Consultant of the Year at Business UK National Awards

- Scoop Social Co. Partners with Fairmont Hotels & Resorts to Elevate Summer Guest Experiences with Italian Inspired Gelato & Beverage Carts

- Boston Industrial Solutions' Natron® 512N Series UV LED Ink Earns CPSIA Certification

- From Factory Floor to Community Heart: The Rebel Spirit of Wisconsin's Wet Wipe Innovators

- Power Business Solutions Announces Joint Venture with EIG Global Trust to Deliver Data Center Financial Solutions

Similar on Rezul

- When Representation No Longer Reflects the District — Why I'm Voting for Pete Verbica

- Off The Hook YS (NY SE: OTH) Executes Transformational Apex Acquisition, Creating Vertically Integrated Marine Powerhouse with $60M Inventory Capacity

- Tri-State Area Entrepreneur Launches K-Chris: A Premium Digital Destination for Luxury Fragrances

- Why One American Manufacturer Builds BBQ Smokers to Aerospace Standards

- Diversified Roofing Solutions Strengthens Industry Leadership With Expanded Roofing Services Across South Florida

- $36 Million LOI to Acquire High Value Assets from Vivakor Inc in Oklahoma's STACK Play — Building Cash Flow and Scalable Power Infrastructure; $OLOX

- Kobie Wins for AI Innovations in the 2026 Stevie® Awards for Sales & Customer Service

- Art of Whiskey Hosts 3rd Annual San Francisco Tasting Experience During Super Bowl Week

- FDA Meeting Indicates a pivotal development that could redefine the treatment landscape for suicidal depression via NRx Pharmaceuticals: $NRXP

- $2.7 Million 2025 Revenue; All Time Record Sales Growth; 6 Profitable Quarters for Homebuilding Industry: Innovative Designs (Stock Symbol: IVDN)

$1 Million Share Repurchase Signals Confidence as Off The Hook YS Scales a Tech-Driven Platform in the $57 Billion U.S. Marine Market

Rezul News/10724550

Off The Hook YS Inc. (N Y S E: OTH) $OTH is Projected to Reach $140 to $145 Million in 2026 and is Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry

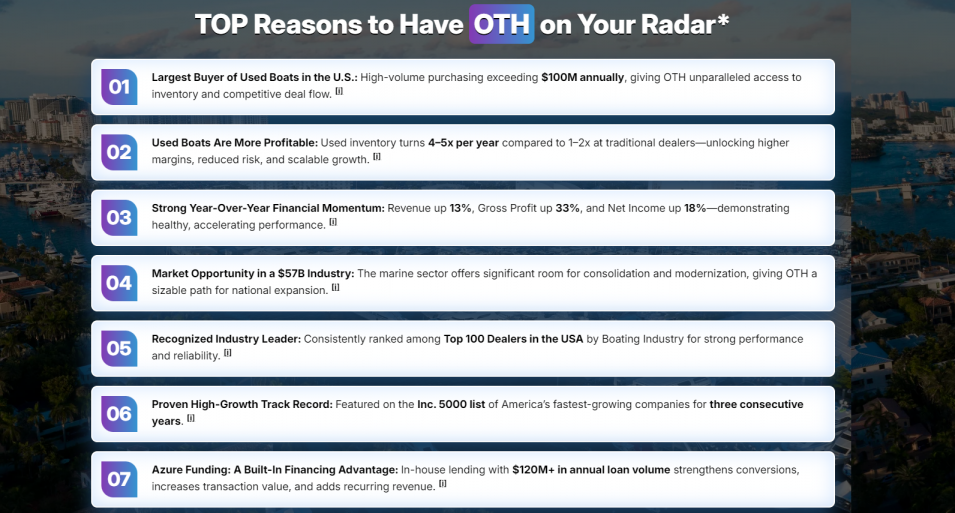

WILMINGTON, N.C. - Rezul -- Off The Hook YS Inc. (N Y S E: OTH) is emerging as one of the most compelling under-the-radar growth stories in the U.S. marine industry. Fresh off its 2025 IPO, the Company has authorized a $1 million share repurchase program, launched a high-end luxury yacht brokerage with over $100 million in listings, and delivered record revenues with accelerating unit volume—all while operating in a fragmented, $57 billion domestic marine market ripe for consolidation.

Management's recent actions suggest a clear message to investors: the current market valuation does not reflect the Company's intrinsic value or its forward growth trajectory.

A Scaled Leader in Pre-Owned Boats—Powered by Technology

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has become one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually.

Unlike traditional brokerages, OTH operates a technology-enabled, asset-intelligent platform, leveraging proprietary AI-assisted valuation tools and a data-driven sales engine to bring speed, transparency, and liquidity to marine transactions. This platform advantage allows OTH to efficiently price inventory, accelerate deal velocity, and manage risk across market cycles.

The Company supports this digital infrastructure with a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales—creating a vertically integrated model few competitors can replicate.

Share Repurchase Program Highlights Undervaluation

On January 8, OTH announced authorization to repurchase up to $1.0 million of its common stock, to be funded through cash on hand and future cash flows.

More on Rezul News

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead," said Brian John, Chief Executive Officer.

The repurchase program underscores management's confidence in the Company's strategy and signals a disciplined capital allocation approach—particularly notable given OTH's early stage as a newly public company with significant growth initiatives underway.

Autograph Yacht Group: A High-Margin Luxury Growth Engine

One of OTH's most intriguing developments is the October 2025 launch of Autograph Yacht Group, its internally created luxury yacht brokerage division.

In just its first quarter of operations, Autograph has:

Autograph operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, placing it squarely in one of the most active luxury boating corridors in the U.S.

What differentiates Autograph is its ability to accept trade-ins, something traditional luxury brokerages typically cannot do. This capability is powered by OTH's proprietary AI platform and wholesale trading operation—creating a structural competitive advantage that improves pricing accuracy, client experience, and transaction velocity.

Financial Momentum and Record Operating Metrics

OTH delivered strong operating performance throughout 2025, highlighted by accelerating unit growth and record revenues.

Nine-Month 2025 Highlights

Q3 2025 Highlights

Importantly, management issued 2026 revenue guidance of $140 million to $145 million, implying a meaningful step-change in scale as Autograph Yacht Group ramps and platform efficiencies compound.

More on Rezul News

Structural Tailwinds: Tax Incentives and Industry Growth

The macro backdrop further strengthens OTH's investment thesis.

The "One Big Beautiful Bill Act", signed into law in July 2025, reinstated 100% bonus depreciation for qualifying boats and yachts purchased and placed into service by January 19, 2026. This incentive creates a powerful, time-bound catalyst for business buyers—especially when combined with OTH's national inventory and aggressive pricing.

Meanwhile, the broader marine ecosystem continues to expand:

OTH's scale, data advantage, and national footprint position it well to capture share in both transactional and recurring marine services over time.

Independent Research Coverage Highlights Margin Inflection Opportunity

Adding further credibility, Digital BD Deep Research issued a detailed investor report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market" (December 8, 2025)

The Bottom Line

Off The Hook YS is no longer just a high-volume boat dealer—it is evolving into a technology-driven marine marketplace with expanding margins, a growing luxury segment, and multiple near-term catalysts. The newly authorized share repurchase program, accelerating luxury brokerage traction, and strong 2026 revenue outlook suggest a company entering its next phase of value creation.

For investors seeking exposure to a differentiated platform within a large, fragmented industry, OTH presents a story that is increasingly difficult to ignore.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Management's recent actions suggest a clear message to investors: the current market valuation does not reflect the Company's intrinsic value or its forward growth trajectory.

A Scaled Leader in Pre-Owned Boats—Powered by Technology

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has become one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually.

Unlike traditional brokerages, OTH operates a technology-enabled, asset-intelligent platform, leveraging proprietary AI-assisted valuation tools and a data-driven sales engine to bring speed, transparency, and liquidity to marine transactions. This platform advantage allows OTH to efficiently price inventory, accelerate deal velocity, and manage risk across market cycles.

The Company supports this digital infrastructure with a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales—creating a vertically integrated model few competitors can replicate.

Share Repurchase Program Highlights Undervaluation

On January 8, OTH announced authorization to repurchase up to $1.0 million of its common stock, to be funded through cash on hand and future cash flows.

More on Rezul News

- Off The Hook YS (NY SE: OTH) Executes Transformational Apex Acquisition, Creating Vertically Integrated Marine Powerhouse with $60M Inventory Capacity

- Tri-State Area Entrepreneur Launches K-Chris: A Premium Digital Destination for Luxury Fragrances

- Why One American Manufacturer Builds BBQ Smokers to Aerospace Standards

- Diversified Roofing Solutions Strengthens Industry Leadership With Expanded Roofing Services Across South Florida

- Bergen County Retail Momentum Continues

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead," said Brian John, Chief Executive Officer.

The repurchase program underscores management's confidence in the Company's strategy and signals a disciplined capital allocation approach—particularly notable given OTH's early stage as a newly public company with significant growth initiatives underway.

Autograph Yacht Group: A High-Margin Luxury Growth Engine

One of OTH's most intriguing developments is the October 2025 launch of Autograph Yacht Group, its internally created luxury yacht brokerage division.

In just its first quarter of operations, Autograph has:

- Secured over $100 million in active listings

- Closed 22 transactions totaling $35 million

- Built strong momentum in yachts ranging from $500,000 to $20 million+

Autograph operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, placing it squarely in one of the most active luxury boating corridors in the U.S.

What differentiates Autograph is its ability to accept trade-ins, something traditional luxury brokerages typically cannot do. This capability is powered by OTH's proprietary AI platform and wholesale trading operation—creating a structural competitive advantage that improves pricing accuracy, client experience, and transaction velocity.

Financial Momentum and Record Operating Metrics

OTH delivered strong operating performance throughout 2025, highlighted by accelerating unit growth and record revenues.

Nine-Month 2025 Highlights

- Record revenue of $82.6 million, up 19.3% year over year

- 310 boats sold, up 24.4%

- Net income of $0.8 million

- Gross profit of $8.4 million, up $1.5 million year over year

Q3 2025 Highlights

- Revenue of $24.0 million

- 112 boats sold, up 51% year over year

- Second-highest quarterly unit sales in Company history

- Adjusted EBITDA of $0.5 million

Importantly, management issued 2026 revenue guidance of $140 million to $145 million, implying a meaningful step-change in scale as Autograph Yacht Group ramps and platform efficiencies compound.

More on Rezul News

- ZRCalc™ Cinema Card Calculator Now Available for Nikon ZR Shooters

- Roof Repair vs. Roof Replacement: Oklahoma Homeowners Urged to Decide Before Storm Season

- Cleveland Vacant Property Owners Exploring Faster Home Selling Options as Maintenance Costs Rise

- Revolutionary Data Solution Transforms Health Insurance Underwriting Accuracy

- Courtesy Connection Delivers AI Call Screening

Structural Tailwinds: Tax Incentives and Industry Growth

The macro backdrop further strengthens OTH's investment thesis.

The "One Big Beautiful Bill Act", signed into law in July 2025, reinstated 100% bonus depreciation for qualifying boats and yachts purchased and placed into service by January 19, 2026. This incentive creates a powerful, time-bound catalyst for business buyers—especially when combined with OTH's national inventory and aggressive pricing.

Meanwhile, the broader marine ecosystem continues to expand:

- The U.S. marine industry is valued at $57 billion

- The U.S. ship repair and maintenance services market is projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033, at a 7.52% CAGR

OTH's scale, data advantage, and national footprint position it well to capture share in both transactional and recurring marine services over time.

Independent Research Coverage Highlights Margin Inflection Opportunity

Adding further credibility, Digital BD Deep Research issued a detailed investor report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market" (December 8, 2025)

The Bottom Line

Off The Hook YS is no longer just a high-volume boat dealer—it is evolving into a technology-driven marine marketplace with expanding margins, a growing luxury segment, and multiple near-term catalysts. The newly authorized share repurchase program, accelerating luxury brokerage traction, and strong 2026 revenue outlook suggest a company entering its next phase of value creation.

For investors seeking exposure to a differentiated platform within a large, fragmented industry, OTH presents a story that is increasingly difficult to ignore.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on Rezul News

- $2.7 Million 2025 Revenue; All Time Record Sales Growth; 6 Profitable Quarters for Homebuilding Industry: Innovative Designs (Stock Symbol: IVDN)

- CCHR: Decades of Warnings, Persistent Inaction; Studies Raise New Alarms on Psychiatric Drug Safety

- PRÝNCESS Builds Anticipation With "My Nerves" — A Girls-Girl Anthem

- Arbutus Medical Raises C$9.3M to Accelerate Growth of Surgical Workflow Solutions Outside the OR

- From Sleepless Nights to Sold-Out Drops: Catch Phrase Poet's First Year Redefining Motivational Urban Apparel

- Cold. Clean. Anywhere. Meet FrostSkin

- How Specialized Game Development Services Are Powering the Next Wave of Interactive Entertainment

- Don't Settle for a Lawyer Who Just Speaks Spanish. Demand One Who Understands Your Story

- Patrick Finney Announces Mid-Construction Milestone at Arvada Full Renovation Project

- Dan Williams Promoted to Century Fasteners Corp. – General Manager, Operations

- Ski Johnson Inks Strategic Deals with Three Major Food Chain Brands

- NIL Club Advances Agent-Free NIL Model as Oversight Intensifies Across College Athletics

- From Track Star to Real Estate Tycoon: The Journey of Olufemi Ajose

- Atlanta Homeowners Increasingly Selling Houses As-Is as Repair Costs and Housing Conditions Evolve

- Atlanta Magazine Names Dr. Rashad Richey One of Atlanta's Most Influential Leaders in 2026 as the FIFA World Cup Approaches

- Apostle Margelee Hylton Announces the Release of Third Day Prayer

- Slotozilla Reports Strong Q4 Growth and Sigma Rome Success

- "Lights Off" and Laughs On: Joseph Neibich Twists Horror Tropes in Hilariously Demonic Fashion

- Families Gain Clarity: Postmortem Pathology Expands Private Autopsy Services in St. Louis

- Beethoven: Music of Revolution and Triumph - Eroica