Popular on Rezul

- Frost Locker: New Research Reveals Mild Cold—Not Extreme Cold—Delivers Real Health Benefits of Cold Therapy - 154

- Wzzph Deploys 5-Million-TPS Trading Engine with Hot-Cold Wallet Architecture Serving 500,000 Active Users Across Latin America - 152

- Faith-Driven Books Empower Professionals to Build Businesses Rooted in Purpose and Integrity - 150

- Phoenix Court-Appointed Realtor Releases Holiday Guidance for Divorce & Probate Home Sales - 150

- Divine Punk Announces Happy Christmas, a Holiday Soundscape by Rebecca Noelle - 146

- Sub-Millisecond Trading Platform: HNZLLQ Introduces Unified Gateway for Philippine Digital Asset Traders - 146

- Spencer Buys Houses Local Home Buying Service Focused on Speed, Fairness, and Simplicity - 140

- Silva Construction Advises Homeowners on Smart Homes and Integrated Technology - 139

- $2.1B Theft Losses: Bitquore Launches 1M+ TPS Platform with 95% Offline Asset Protection for U.S. Traders - 138

- Bookmakers Review Releases 2028 Democratic Nominee Betting Odds: Newsom Leads Early Field - 134

Similar on Rezul

- Allen Field Co., Inc. Components Selected for Esko ArtiosCAD 3D Component Library

- Corcoran DeRonja Real Estate Welcomes Siobhán Simões to Its Growing Team

- UK Financial Ltd Celebrates Global Recognition as MayaCat (MCAT) Evolves Into SMCAT — The World's First Meme Coin Under ERC-3643 Compliance

- U.S. Military to Benefit from Drone Tech Agreement with NovaSpark Energy, Plus Longer NASA Space Missions via Solar Power Leader: Ascent Solar $ASTI

- $76 Million in Gold & Silver Holdings and Expanding Production — Pioneering the Future of Gold: Asia Broadband Inc. (Stock Symbol: AABB) is Surging

- Wohler announces three SRT monitoring enhancements for its iVAM2-MPEG monitor and the addition of front panel PID selection of A/V/subtitle streams

- 20 Million Financing to Accelerate Growth and Advance Digital Asset Strategy Secured for Super League (N A S D A Q: SLE)

- Webinar Announcement: Reputational Risk Management in Internal Investigations: Controlling the Narrative Before, During, and After a Crisis

- Vet Maps Launches National Platform to Spotlight Veteran-Owned Businesses and Causes

- $114.6 Million in Revenues, Up 54%: Uni-Fuels Holdings (N A S D A Q: UFG) Accelerates Global Expansion Across Major Shipping Hubs as Demand Surges

$1 Billion Revenue Target, $15M EBITDA Run Rate Plan, and a Breakout Moment for This Global Tech Powerhouse: IQSTEL, Inc. (N A S D A Q: IQST):

Rezul News/10712570

$IQST Institutions are Buying...Why? IQST is Undervalued at $7

CORAL GABLES, Fla. - Rezul -- August 2025 — In a marketplace increasingly defined by rapid innovation, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a rare standout — delivering real revenues, rapid profitability milestones, and strategic diversification across the most exciting sectors in tech: telecom, fintech, electric vehicles, artificial intelligence, and cybersecurity.

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on Rezul News

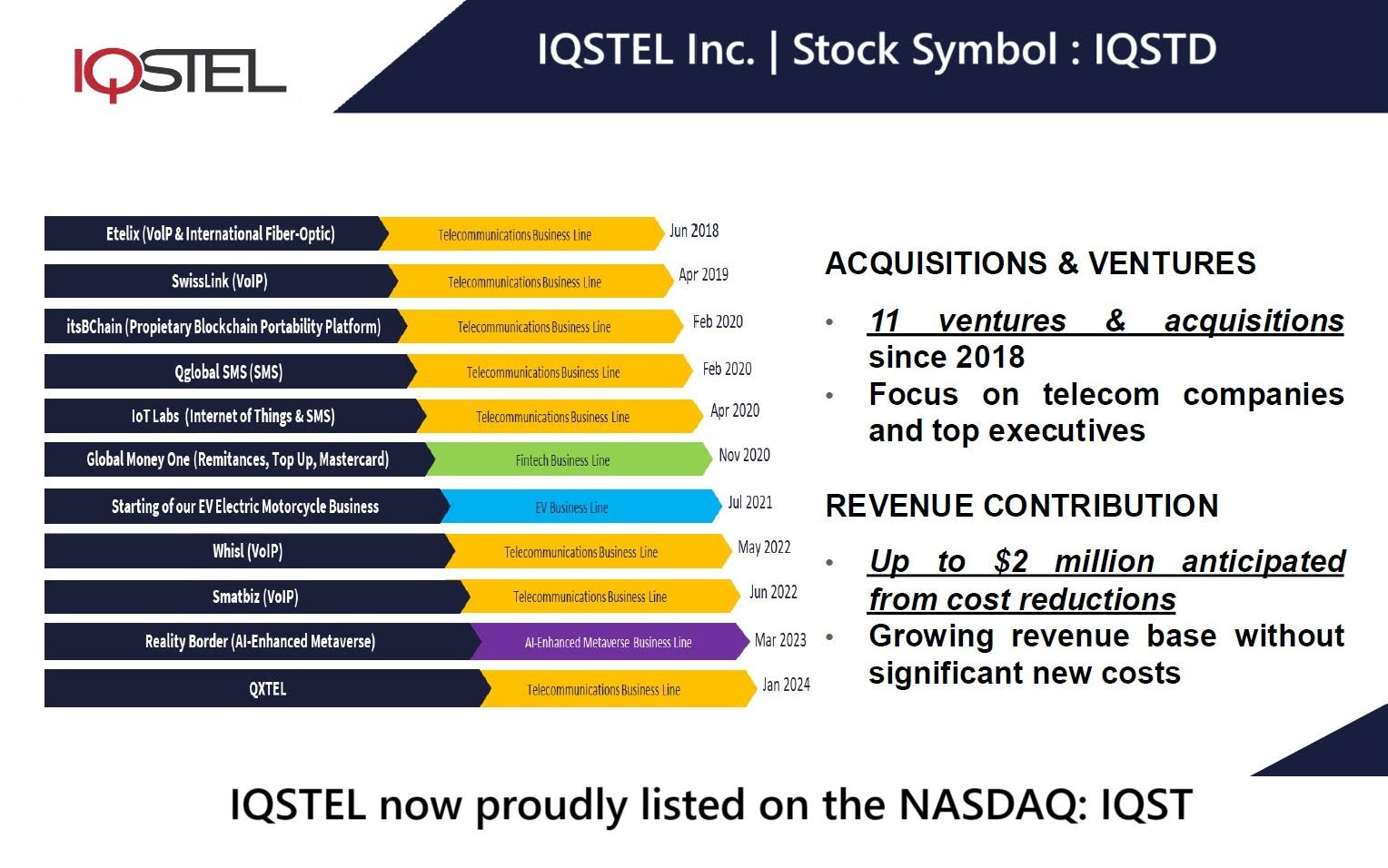

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

Recent Highlights Validating the Strategy

Analyst Endorsement and Institutional Interest Rising

More on Rezul News

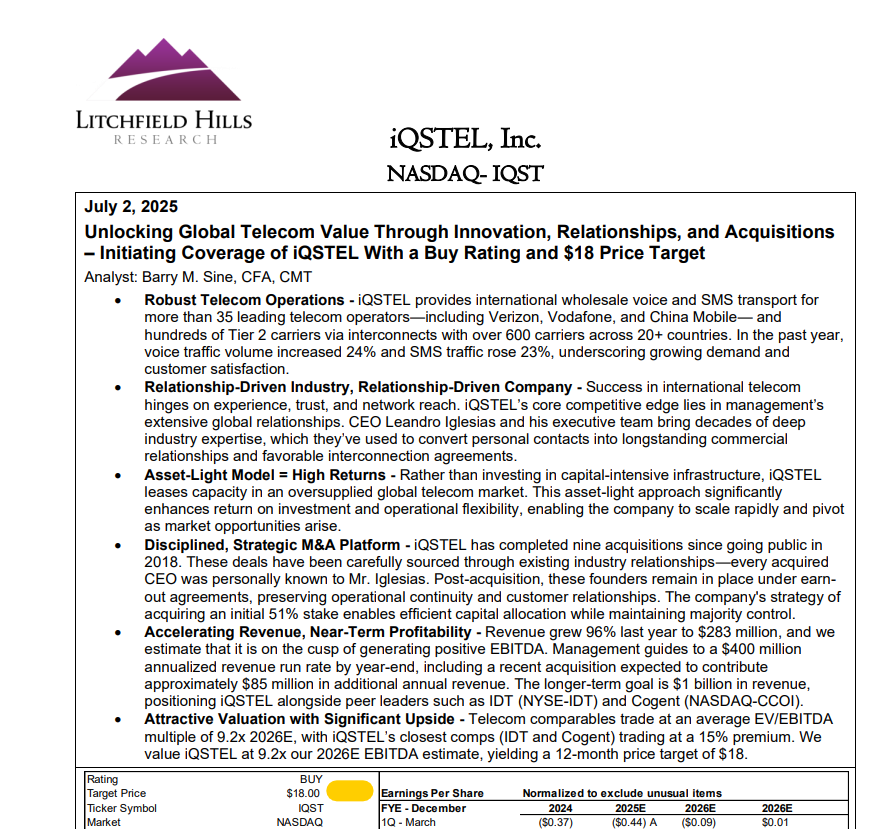

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

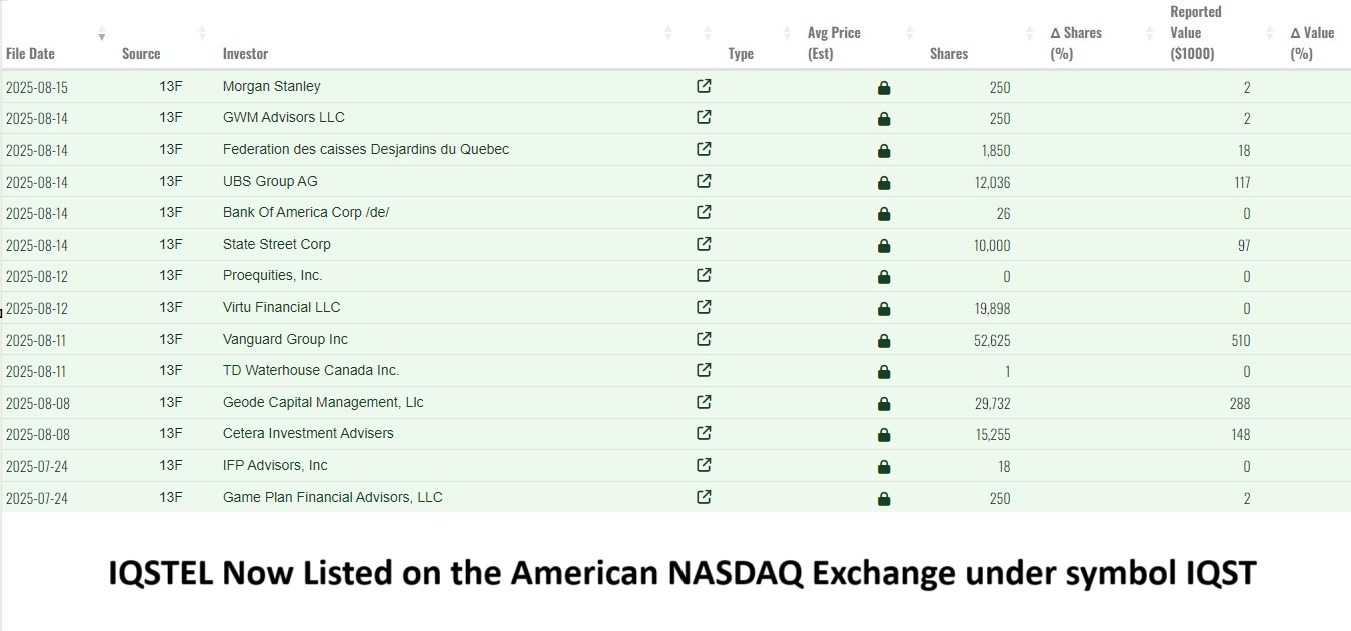

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

- $35M in July revenue alone — puts the company ahead of schedule on its $400M+ run rate

- $17.41 in assets per share, equity per share up to $4.84

- $6.9M in debt eliminated, or nearly $2 per share, strengthening the balance sheet

- Litchfield Hills Research reaffirms $18 price target, citing strong Q2 performance

- New dividend catalyst: IQST shareholders to receive shares in ASII as part of Nasdaq uplisting strategy

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on Rezul News

- The Lashe® Announces Exclusive November Savings for Lash and Beauty Professionals

- Corcoran DeRonja Real Estate Welcomes Siobhán Simões to Its Growing Team

- November is Lung Cancer Awareness Month: Screening Saves Aims to Increase Access to Lung Screenings in NC

- Valeo Health Leads a New Era of Longevity and Preventive Health in the UAE

- Torch Entertainment Presents The Frozen Zoo

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

- Telecom: $600M+ in historical revenue, strong recurring business, trusted by 600+ operators worldwide

- Fintech: Expansion accelerated by the July 1st acquisition of GlobeTopper, forecasting $34M in H2 revenue and positive EBITDA

- AI: Launch of IQ2Call — an AI-powered, multilingual call center disrupting the $750B global telecom customer service market

- Cybersecurity & Blockchain: Active product development underway to support enterprise and consumer needs globally

Recent Highlights Validating the Strategy

- Q2 2025 Financials (Ended June 30, 2025):

- Gross revenues grew 17% YoY (100% organic growth)

- Gross margin improved by 7.45%

- Net shareholder equity up 20% in 6 months

- Common equity conversions absorbed by the market with no dilution impact

- Equity Exchange and Dividend Partnership with CYCU:

- IQST and CYCU signed an MOU for mutual equity stakes and shareholder dividends in each company — strengthening IQST's shareholder value proposition

Analyst Endorsement and Institutional Interest Rising

More on Rezul News

- Sweet Memories Vintage Tees Debuts Historic ORCA™ Beverage Nostalgic Soda Collection

- UK Financial Ltd Celebrates Global Recognition as MayaCat (MCAT) Evolves Into SMCAT — The World's First Meme Coin Under ERC-3643 Compliance

- U.S. Military to Benefit from Drone Tech Agreement with NovaSpark Energy, Plus Longer NASA Space Missions via Solar Power Leader: Ascent Solar $ASTI

- $76 Million in Gold & Silver Holdings and Expanding Production — Pioneering the Future of Gold: Asia Broadband Inc. (Stock Symbol: AABB) is Surging

- Wohler announces three SRT monitoring enhancements for its iVAM2-MPEG monitor and the addition of front panel PID selection of A/V/subtitle streams

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on Rezul News

- TradingHabits.com Launches to Support Day Trader Well-being

- Denver Apartment Finders Launches Redesigned Homepage to Simplify Moves from Dallas to Denver

- $750 Million Market on Track to $3.35 Billion by 2034: $NRXP Launches First-in-Florida "One Day" Depression Treatment in Partnership with Ampa Health

- Q3 2025 | Houston Retail Market Report

- 10% Thanksgiving Discount on Holiday Interior Painting for Boulder Homes

- Wall Street Just Booked a One-Way Ticket to Texas

- $750 Million Market Set to Soar to $3.35 Billion by 2034 as Florida Launches First-in-Nation One-Day: NRx Pharmaceuticals (N A S D A Q: NRXP) $NRXP

- BITE Data raises $3m to build AI tools for global trade compliance teams

- Phinge Issues Notice of Possible Infringement, Investigates App-less AI Agents & Technology for Unauthorized Use of its Patented App-less Technologies

- South Florida Real Estate BocaRealty.com & BoyntonRealty.com Updated Websites for Buyers and Seller

- Vero Beach, FL: Rental Properties Market Overview

- Huntington Learning Center of Russellville Marks 1 Year Anniversary; Extends Reduced Grant-Aligned Rates to All Students in Learning Center Services

- CCHR Supports Call to End Coercive Psychiatry at World Mental Health Congress

- purelyIV Expands Wellness Services with Flu/COVID Testing and Menopause Coaching & Treatment

- WHES Retains BloombergNEF Tier 1 Ranking for Sixth Consecutive Quarter

- U.S. Entrepreneur Anjo De Heus Builds Innovation Bridge Between America and the Gulf

- UK Financial Ltd Confirms All 8 Mexican Gold Mines Exist — Audited and Backing UKFL's Ecosystem With Double the 2018 Gold Value

- Veterans Day 2025: Honoring Service Through Storytelling

- Kaltra Offers Microchannel Condensers Optimized for Low-GWP Refrigerants R454B, R32, and R290

- Putting Your Roses to Bed for Winter in the Deep South - A Gentleman's Guide to Fall Rose Care